Halloween horror: yogurt drives growth as chocolate confectionery declines

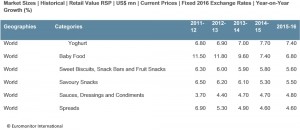

According to the Euromonitor figures, year-on-year growth for chocolate confectionery rose from 1.3% in 2011-12 to 2.1% in 2012-13, but then saw a decline to 1.1% the following year, and then -1.6% in 2014-15.

For 2015-16, the figures show a -0.2% decline.

The figures are the same for gum, which saw year-on-year growth of 0.9% in 2013-14, only to drop the following two years.

The numbers for sugar confectionery are a little better: 1.9% growth in 2013-14, a drop of -1.5% the following year, and 0.1% growth in 2015-16.

The rise of yogurt

Yogurt, on the other hand, has seen a steady rise to 7.7% growth in 2014-15, and while that dropped to 7.4% in 2015-16, it still leads the way in the top packaged food categories, beating off baby food, which also saw a slight decline in growth.

Raphael Moreau, food analyst at Euromonitor International said that the ‘war on sugar’ has dented the potential demand of sweet snacks as consumers have greater awareness of ingredients used in food production and are more cautious about their consumption.

“A growing “back to basics” mentality towards food has meant that many old recipes and materials are being rediscovered by consumers,” he said.

“Yogurt, for a long time, has been moving away from its original position as a cooking ingredient to a sweet snack. A growing number of consumer-driven combinations using toppings such as cereal or fruits have transformed this staple into a highly personalized snack.”

Disappointing year

He noted that the shift towards more convenient packaging also helps manufacturers target children more directly.

Recent innovations have highlighted how sales growth in yogurt is expected to be sustained through targeting a wider range of consumption occasions, he added, as yogurt straddles the boundaries between health and indulgence as well as between home and on-the go consumption.

Overall, 2015 and 2016 proved to be disappointing years for the global food industry as key emerging markets, China and Brazil, underperform, Euromonitor said.

Riding the health and wellness wave

Lamine Lahouasnia, head of packaged food at Euromonitor International, said that faced with a low growth future, many food companies have chosen to ride the health and wellness wave.

“This strategy generally requires investment, either in research and development or capital for acquisitions,” Lahouasnia said.

“Danone's recent purchase of WhiteWave is perhaps a good example of this.”

The second strategy, he said, centers on on-the-go consumption and turning more food products into snacking variants.

“Snacks have certainly been relatively immune to the low growth environment that afflicts the rest of packaged food. Companies like PepsiCo, Lindt and Ferrero have shown that solid returns can be made in snacking.”

He added that a third route focuses on key brands/categories to improve profitability.