Interactive Map

The new world of chocolate: How is consumption in emerging markets developing?

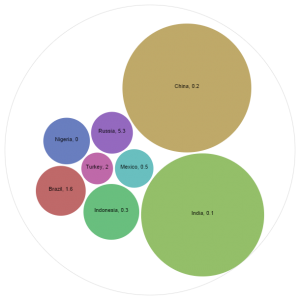

ConfectioneryNews has mapped Euromonitor International’s 2014 per capita chocolate consumption data for the emerging markets of Brazil, Russia, India and China (BRIC), and Mexico, Indonesia, Nigeria and Turkey (MINT).

Emerging vs Developed

Chocolate consumption has grown or remained static in every BRIC or MINT market since 2012. These countries buck the trend of some developed markets such as the US, where chocolate consumption has declined. See HERE for the top 20 chocolate consuming nations.

Russia is the only emerging market to feature in the top 20 consuming nations and has the highest chocolate consumption among the BRIC and MINT nations by some distance.

However, Turkey and India have been earmarked as the ones to watch for the future.

India: ‘Standout market’

“I'd say that India - whilst per capita consumption is still very low - will continue to be the standout market over the next few years as the fastest growing confectionery market globally,” said Lauren Bandy, ingredients analyst at Euromonitor.

She said that while Mondelēz dominated the Indian market through its Cadbury brand, other multinationals such as Nestle, Mars and Ferrero had made India central to their growth strategies.

“Nearly every brand offers a single, small version of their products at a very low price (Rs 10-20, which is just a few cents); has made chocolate confectionery affordable to rural and third tier city consumers - confectionery players are then able to take advantage of the sheer size of India's population for growth," she said.

India is home to 1.2bn people, 68% of whom live in rural areas, according to a study by ValueNotes.

[Source: Consumption data (Euromonitor International), Population (Central Intelligence Agency) GDP figures (The World Bank)]

The numbers game: Big population equals big opportunity

The BRIC and MINT nations are all in the top 20 most populous countries in the world, according to the Central Intelligence Agency. The emerging markets account for seven of the top 10 most populated countries globally. The size of the circles (left) shows the countries with the biggest populations. Each countries' Kg per capita chocolate consumption for 2014 is listed in the circle.

Turkey: Strong growth

“Growth in Turkey is expected to be strong too, as disposable incomes rise, consumers in developing markets switch from cheaper sugar confectionery to more premium chocolate confectionery,” said Bandy. "This has been combined with a strong wave of NPD, particularly in chocolate tablets.”

Major chocolate and cocoa players such as Barry Callebaut and Ferrero have built factories in Turkey to seize on the growing market. See HERE for more on where confectionery production is moving.