First-half

UK chocolate exports grow in value driven by premium brands

“This is due to increased sales of higher quality branded products,” an FDF spokesperson told ConfectioneryNews.

It comes as the country is in a chocolate trade deficit, whereby the nation’s imports of chocolate outstrip exports by value.

Quality products driving exports

First half (H1) January to June chocolate exports from the UK declined -5.6% in volume year-on-year, accordng to FDF data.

However, chocolate export value sales grew +2.9% to £8.5m ($11m) over the period.

Chocolate was the fourth largest UK food & drink export by value behind whisky, salmon and beer. But chocolate was overtaken by beer during the period.

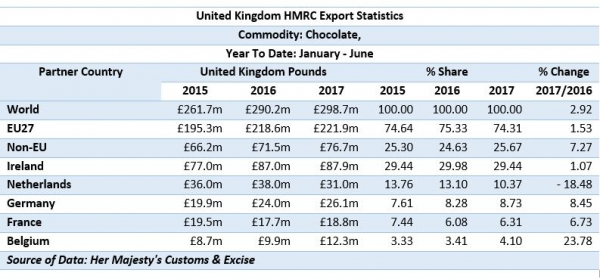

Chocolate exports by value grew faster in non-EU countries (+7.27%) compared to within the union (+1.53%). Exports to Germany (+8.45%), France (+6.73%) and Belgium (+23.78%) were the fastest growing of the UK’s top five chocolate export markets by value.

However, chocolate exports to the Netherlands – the second main export destination for UK chocolate – declined -18.48% in H1.

Sugar confectionery exports surge

UK sugar confectionery exports grew even fastest than chocolate in H1, up +12.26% in value.

The nation reported strong growth in sugar confectionery exports to Germany (+24.8%), Netherlands (+80.11%), France (+21.35) and Belgium (+89.25%).

Mars-Wrigley and Nestlé are among the key exporters of UK confectionery through brands such as Wrigley Extra and KitKat.

Food and drink overall

Overall UK food and drink exports grew +8.5% in value in H1 to £10.2bn ($13.2bn), including stronger growth to EU countries (+9%) than to countries outside the EU (+7.6%).

It was also the highest half year on record for branded food and drink exports up +11.3% to £2.7bn ($3.5bn) in H1 2017.

Chocolate trade deficit

A recent FDF-commissioned report by Grant Thornton said the UK has increased its dependence on food and drink imports since 2012 with imports now outstripping exports.

The UK has a larger food and drink trade deficit than many major consuming countries such as the US, Brazil, Germany, France, Ireland and Australia, it found.

In confectionery (chocolate and sugar confectionery) the trade deficit stood at £1.8m ($2.3m) in 2016.

Euromonitor International projects annual value sales in UK chocolate market will decline -7.2% from $8.16bn in 2016 to $7.57bn in 2021.

‘Brexit is both threat and opportunity’

The FDF said it does not forecast trade deficit expectations for specific categories, but said Brexit negotiations will be key for the export-import balance in chocolate.

“Brexit is both threat and opportunity – much will depend on the terms that are secured as we leave the EU,” said FDF’s spokesperson.

“Also, the quality of FTAs that the UK Government is able to secure independently from the EU and the speed that they enter into force could have a significant impact.

“On top of that, the strength of the pound will play a role as well as movements in key commodity markets for sugar, cocoa, milk as well as other vital inputs such as packaging,” they said.