United Biscuits’ private equity owners coy on flotation

UK newspaper The Telegraph said that the private equity houses could begin a public offering of United Biscuits as early as September 2014, citing ‘senior banking sources’.

Blackstone and PAI both refused to comment on the speculation when asked by FoodNavigator.

Jaffa Cakes and McVitie’s brand owner United Biscuits has long been tight-lipped on spates of sale speculation since a failed bid to sell its joint biscuit and salty snacks business for £2bn ($3.4bn) to Chinese firm Bright Foods in 2010.

Blackstone and PAI Partners spilt its salty snacks arm of United Biscuits that included brands such as Hula Hoops and KP snacks in 2012. It sold the division to Intersnack later that year for £500m ($854m).

United Biscuits has previously been linked to big names such as Kellogg, Mondelēz International and Ülker.

UB market shares

#1 – UK

#2 – France, Belgium, Holland, Republic of Ireland

#4 – Global (behind Mondelez, Kellogg and Campbell’s Soup respectively. Turkish firm Ülker is in fifth.)

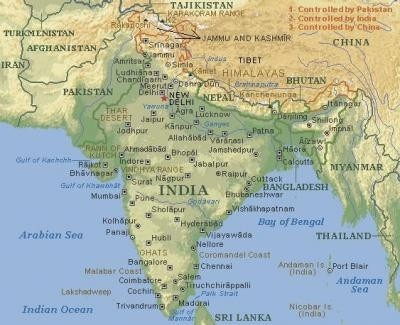

United biscuits operations

The company is the number four biscuit player in the world and market leader in the UK. Around 15% of the company’s sales come outside of the UK and North West Europe. It posted £1bn ($1.7bn) in sales in fiscal 2012.

The firm has seven factories in the UK, two in France, one in Holland, Belgium and India and a licensed facility in Nigeria.

Last year, United Biscuits also acquired Rana Confectionery Products’ business in Saudi Arabia, which gave the firm a manufacturing base in the region.