INFOGRAPHIC

Top 10 chocolate brands: US candy market dollar sales rise

ConfectioneryNews analyzes sales data for multiple outlets in the US including C-stores and supermarkets from market analysts IRI for the 52 weeks up to August 7, 2016.

The data shows a strong performance from market leaders Mars and Hershey and share losses for Nestlé USA.

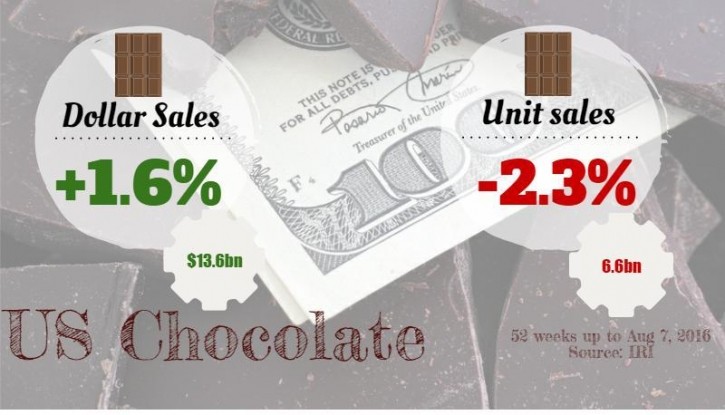

The chocolate market is being driven by value. US chocolate confectionery value sales over the period were up 1.6% to $13.6bn, but unit sales fell 2.3%.

Chocolate products were on average $0.08 more expensive than the prior year, averaging $2.07 per unit.

SMALLER SIZES: Mars & Hershey

Dollar sales for chocolate weighing less than 3.5 oz. (99 g) grew 2.4%, but unit sales for this segment declined 0.5%.

Hershey was the strongest performer in small sizes. It posted $2bn in sales in the category, up 2.7% year on year.

Hershey accounted for almost half of value sales in the small size US chocolate category, behind its nearest competitor Mars, which made up 36.3% of total category sales.

Hershey’s Reese’s brand extended its lead of the smaller size category with 6.2% dollar sales growth, while Hershey’s Chocolate brand also increased value sales 1.8%. Hershey’s Almond Joy brand was a particularly strong performer with dollar sales up 10%.

Mars’ dollar sales in small size chocolate were up 2.9% with solid performance from M&M’s and Twix 4 To Go.

CHOCOLATE CANDY BOX/BAG/BAR < 3.5OZ

[52 Weeks Ending Aug 7, 2016 (YOY) - Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains)]

Source: IRI, Chicago-based market research firm (@iriworldwide )

SMALLER SIZES: Nestlé USA, Lindt & Ferrero

During Nestlé’s H1 results call last month, its CFO François Roger said the company was facing “intense competition in the mainstream segment” in US confectionery. This was evidenced in IRI’s data.

Nestlé USA’s value sales dropped 14.1% in small size chocolate during the period. It was the number three player in the smaller size category, but Butterfinger was its only product to feature in the top 20, and sales from the brand were down 18.17%.

Jean-Philippe Bertschy, an analyst at Bank Vontobel, recently suggested Nestlé consider offloading its US confectionery operations, particularly as its global bestseller KitKat is licensed to Hershey in the US.

Mondelēz said last week that it continues to explore acquisition targets after recently dropping its interest in Hershey.

Lindt – which outperformed the chocolate industry globally last year – saw declines in smaller formats in US chocolate over the period. The company’s dollar sales fell 4.5% in the category and none of its brands made the top 20.

Ferrero USA also had no brands in the top 20, but raised its total dollar sales 7.8% in smaller chocolate formats.

The Italian owned confectioner has been touted as another possible acquisition target for Mondelēz.

LARGER SIZES

Dollar sales for chocolate weighing more than 3.5 oz. (99g) were up 1.6% in value and 0.3% in unit sales during the period.

Hershey led the category, accounting for 39% of overall sales. Hershey’s Chocolate, Reese’s and Kisses all posted dollar sales growth. However, Brookside chocolate sales were down 22%.

Number two player Mars registered 3.7% growth in larger sizes driven by its M&M’s brand, which increased dollar sales by 10.3%, despite a price reduction of $0.06 on average.

Nestlé USA posted a 2.2% decline in the category as its Butterfinger and Raisinets brands both recorded dollar sales declines.

Lindt posted a solid performance in larger sizes with 2.9% value sales growth for Lindt & Sprüngli and 3.6% growth for its subsidiary Ghirardelli. Value sales for its best-performing brand, Lindor, were up 4.5%.

CHOCOLATE CANDY BOX/BAG/BAR > 3.5OZ

[52 Weeks Ending Aug 7, 2016 (YOY) - Total U.S. Multi-Outlet w/ C-Store (Supermarkets, Drugstores, Mass Market Retailers, Gas/C-Stores, Military Commissaries and Select Club & Dollar Retail Chains)]

Source: IRI, Chicago-based market research firm (@iriworldwide )

N.B. – Data for overall chocolate includes snack sizes, gift boxes, novelties and sugar free chocolate, which are not featured in our analysis.