Barry Callebaut revenues grow with Mondelēz and GarudaFood deals

This came despite declining sales volumes in the overall global chocolate market.

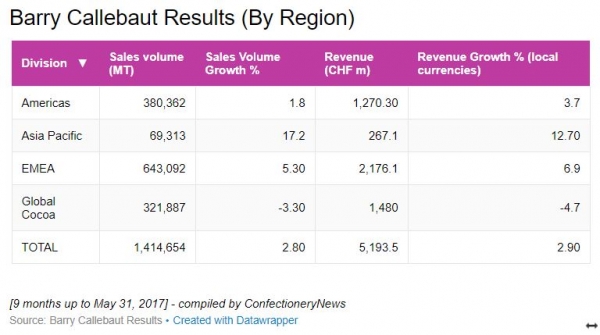

The group grew its sales volume by +2.8% to 1,414,654 metric tons (MT), while revenues were up +2.9% in local currencies to CHF 5.2bn ($5.4bn), for the first nine months of fiscal year 2016/17 (ending May 31, 2017).

GarudaFood and Mondelēz deals drive growth

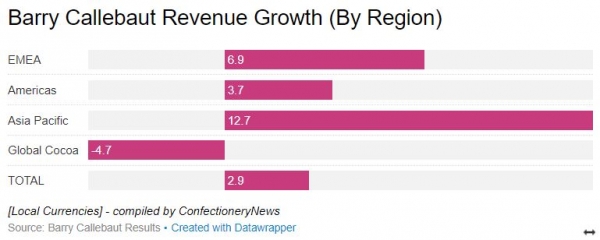

Barry Callebaut’s revenue growth was strongest in Asia-Pacific, spurred by a deal signed in 2015 to supply Indonesian biscuit firm GarudaFood 10,000 metric tons of compound chocolate per year.

The company also reported strong revenue growth in Europe, Middle East and Africa (EMEA) driven by a recent deal to supply Mondelēz International. It also added sales volumes of vending powder mixes after acquiring a Friesland Campina Beverages division in March 2016.

Barry Callebaut last year snapped up a chocolate plant from Mondelēz International in Halle, Belgium and agreed to supply the Milka maker 30,000 metric tons of liquid chocolate annually.

It's also producing some consumer goods from Mondelēz at the plant, which mainly produces Côte d'Or chocolate.

Barry Callebaut gourmet and specialty products - which supplies premium products such as nuts and inclusions to chefs and artisans - also performed well in Western Europe in its first nine months.

Regional breakdown

Chocolate market declines, then recovers

Antoine de Saint-Affrique, CEO of the Barry Callebaut Group, said:“Thanks to our healthy chocolate portfolio, we maintained good volume growth momentum and managed to outperform the market once again.”

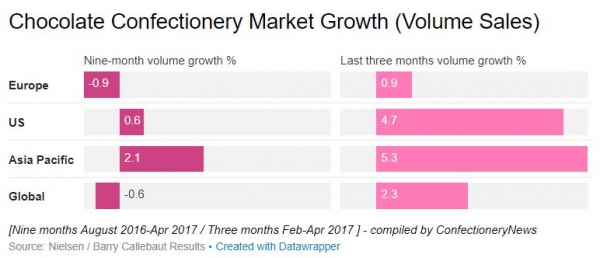

Sales volumes in the global chocolate confectionery market declined -0.6% from August 2016 until April 2017, according to Nielsen data.

Europe’s chocolate sales volumes fell -0.9%, and by -0.6% in the US over the same period.

However, the chocolate market has rebounded in the last three months.

Sales volumes in the global chocolate market grew +2.3% from February to April 2017, by +0.9% in Europe and by +4.7% in the US, according to Nielsen.

Overall chocolate market

Global cocoa and outlook

Barry Callebaut reported declines in its Global Cocoa division, which supplies cocoa ingredients such as butter, powder and liquor.

It came as it intentionally phased-out of less profitable contracts, amounting to 50,000-60,000 MT.

The company maintained its mid-term guidance of 4-6% volume growth on average for the 3-year period 2015/16 and EBIT above volume growth in local currencies.

[Background reading....How did cocoa processing in Europe progress in Q2?]