‘Are Brands Too Late to go to China’, a recently published industry note from Rabobank used the Chinese confectionery sub-segment as a reference for the wider processed food industry.

Foreign brands hold a 70% market share in China, but there is still room for newcomers if they are able to master distribution in a fragmented market, the report concluded.

Rabobank analyst and author of the note Ivan Choi told ConfectioneryNews.com: “The distribution is still weak in China”

‘Tier 1-2 cities’ such as Beijing and Shanghai have stronger distribution channels through modern retail outlets such as supermarkets and convenience stores whereas rural, tier 3-5 cities, feature more independent grocers and are difficult to penetrate, he said.

Retail partnership

Traditional retailers still account for almost 40% of retail sales across China, according to Rabobank.

“We suggest partnering with the retailers because they are expanding across tier 1-2 cities and are also moving to tiers 3-5,” said Choi.

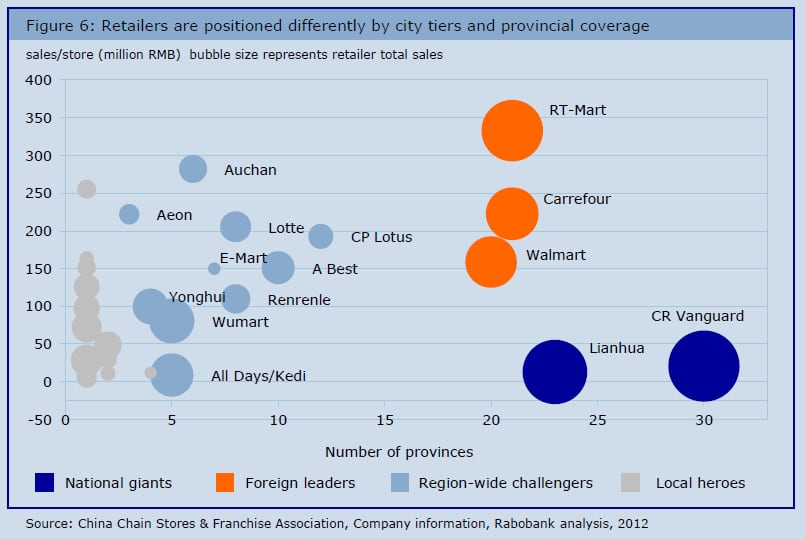

National retail giants Lianhua and CR Vanguard are entering more provinces, while foreign retailers such as RT-Mart, Carrefour and Walmart are also expanding.

Another way is to partner with a local brand such as Nestlé’s partnership with Hsu Fu Chi, or to use middlemen distributors, said Choi.

“However, these middlemen are not quite professional,” he said, adding that their organization of inventory and supply chain management was not up to EU and US standards.

Big cities

According to Rabobank , confectioner sshould focus on specific cities or provinces.

Companies with premium offerings should target tier 1-2 cities where the €4.6bn ($5.9bn) confectionery market is growing 10% annually, it said.

Lindt, for example, is only present in Beijing and Shanghai , while Ferrero has enjoyed success by sticking with high-end retailers and keeping higher price points for Ferrero Rocher.

FACT: Per capita chocolate consumption

China - 1.2 kg

Global average –2.1 Kg

Rural provinces

Companies with lower priced products should target tier 3-5 cities, which are mainly in North and West, said Choi.

The confectionery market in these regions is worth €3.1bn ($3.9bn) and is forecast to grow at a slower rate of 6% annually as chocolate consumption is much lower than tier 1-2 cities.

Tiers 1-5

Tier 1: Beijing, Shanghai, Guangzhou

Tier 2: 19 provincial capitals and Chongqing, Shenzhen, Qingdao, Dalian and Tianjin

Tier 3: 228 prefecture cities

Tier 4: 322 county cities

Tier 5: 1,300 counties

Market leader Mars commands 38.1% of the Chinese confectionery market with its Dove brand, but has only a 35% penetration rate giving it potential to expand distribution to tier 3-5 cities, said Rabobank.

Consumer profile

Rabobank added that Chinese consumers were less brand loyal and may shift allegiance to better-value or better tasting products, which leaves space for newcomers.

European and American brands also convey a higher status and are viewed as safer, which is important to consumers after the dairy industry’s 2008 melamine crisis, said the industry note.

Rabobank added that Chinese consumers preferred chocolate with below 65% cocoa content and considered dark chocolate dry and bitter.