Mintel’s latest ‘Cookies and Crackers’ report for Brazil details how value sales in the category grew 30% from 2007-12 to reach R$10bn (US $4.9bn). The research organization forecasts that the market will grow further to reach R12.5bn (US $6bn) by 2017.

Jean Manuel Gonçalves, senior food analyst at Mintel, told ConfectioneryNews that said that opportunities existed in three areas.

Functional cookies for women

“The biggest one is the female consumers.” Brazilian women consume more indulgent products than men making the cookie category attractive, he said.

“Cookies have this nutrition appeal that other indulgent categories don’t have.”

Gonçalves said the biscuits market lacked a brand similar to Danone’s Activia yoghurt that could be marketed to women.

Healthier products for children

Another prospect is fortified products for young people.

The analyst said that regulators were increasingly trying to curb indulgent eating after childhood obesity was found to have tripled in Brazil over 35 years to 2009.

He said there was an opportunity to introduce functional products such as ones fortified with vitamins that would appeal to parents.

Seniors

Products targeted at seniors are another area of interest. “They don’t consume a lot of the indulgent category, but consume as much as young people in savory crackers,” said Gonçalves.

Around 70% of those aged over 45 in Brazil eat cookies or crackers at least once a week. Mintel believes healthy products may encourage this age group to diversify.

Gonçalves said one option was vitamin fortified easy to chew/swallow salty crackers in easy-open packs.

Production costs

In the last three years, there has been a 36% increase in the average price of biscuits in Brazil (more than the US, Mexico and UK) .

Rising values sales were partly driven by higher production costs for manufacturers, including the price of wheat, sugar and packaging. This led brand owners to add value to their products to justify price increases.

For example, adding value has included improving the flavour and crunchiness of conventionally cheap corn starch cookies.

Gonçalves said this has led people to trade up to higher quality products and had heightened taste expectations.

Local tastes

“The cookies and crackers category has a very local element attached to it,” he added.

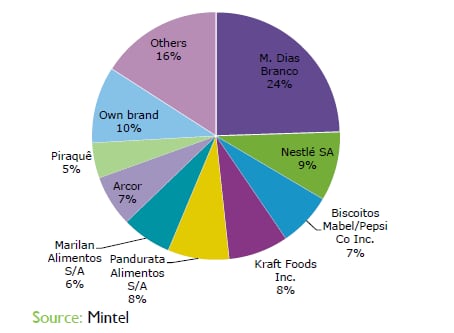

Mondelez, Nestlé and Arcor are present in the market, but unlike the candy and chewing gum market, the Brazilian biscuits market is more fragmented as local recipes and taste preferences leave room for smaller domestic brands.

The market is led by domestic firm M. Dias Branco which commands a 24% share.