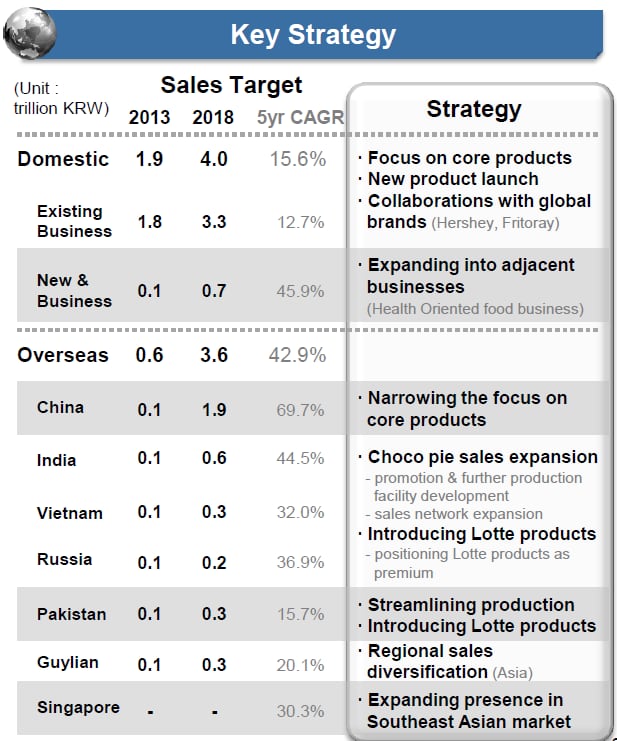

Its current overseas operation is expected to total KRW 0.6 trillion ($565.7m) in 2013 and Lotte is projecting that overseas sales will reach KRW 3.6 trn ($3.4bn) by 2018 – a five-year compound annual growth rate of 42.9%.

The company and all of its subsidiaries endured a difficult H1 2013 as it posted a net loss of 40,452 m KRW ($38.1m).

Lotte is aiming to become Asia’s leading confectionery firm by 2018 and China is integral to its plans.

Northern China for Choco Pie and biscuits

China is the company’s largest overseas operation. In China, Lotte owns four factories and has a workforce of 2,958, producing and selling Lotte gum products, Choco Pie, biscuits and chocolate.

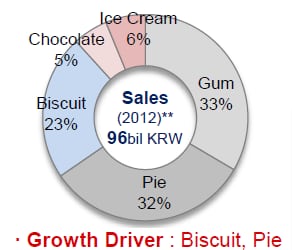

Lotte said in its H1 results that its biscuit and pie categories were driving growth in China.

The company’s China sales come mainly from gum (33%) then 32% from its pie category (Lotte Choco Pie). Chocolate only accounts for 5% of Lotte’s China sales and its chocolate is manufactured outside of the country.

The company intends to narrow its focus in China to concentrate on core products: Koala’s March (biscuits), Choco Pie, Xylitol (gum), ID (gum) and Pepero (snacks).

The company said it would focus on North China, particularly two core cities: Beijing and Tianjin.

Premium positioning in Russia

Lotte is headquartered in Seoul and operates four plants in Korea. It has overseas operations in Russia, China, Vietnam, Singapore, India, Pakistan, Belgium and more recently Kazakhstan through its 2013 Rakhat acquisition.

Lotte’s sales have been growing above the market average in India, Vietnam, Pakistan and Russia.

For example, while the overall Russian confectionery market registered a 2.6% CAGR from 2010-12, Lotte saw a 62.6% CAGR over the same period as the company expanded its Choco Pie brand across the country. Lotte said in its H1 results that it would adopt a premium positioning for its products in Russia to foster further growth.

India and Pakistan

The firm said that it would focus upon expanding Choco Pie sales in India, Russia and Vietnam and would look to grow its portfolio in Pakistan.

The company’s sales mix in India is mainly candy and the firm does not sell chocolate in the market. In Pakistan, where the firm has four factories, Lotte sells only snacks, biscuits and pasta.

Guylian grows in Asia

Lotte is also present in Belgium with Guylian, which it acquired in 2008.

Over half of Lotte’s sales for Guylian come in Europe, but the company said that the brand grew fastest in Asia during H1 by making the most of Lotte’s sales network.

Korea: Home market

Lotte upped its domestic sales in H1 by4.2% to KRW 788 bn KRW ($743m), but its domestic net profit fell 15.3% to KRW 51bn ($48m).

The company’s domestic sales have seen a 6.7% compound annual growth rate (CAGR) in the past five making it the leading player in Korea’s confectionery and ice cream market.

The majority, 25% of its domestic sales come from ice cream, followed by chocolate (18%) and biscuits (17%).

In its domestic market, Lotte said that it would concentrate on core products and collaborations with global brands such as Hershey and Frito-Lay.