However, UK confectionery prices may creep slowly up in the longer term and volumes sales may be challenged, it says.

Too early for the Brexit effect

Speaking to ConfectioneryNews, Tim Eales, director of strategic insight at IRI, said: "We've not seen any serious effect of prices going up that can be directly attributed to Brexit at this point."

Prices for all grocery items excluding alcohol dropped 4.6% between February 2014 and November 2016, according to IRI’s latest report.

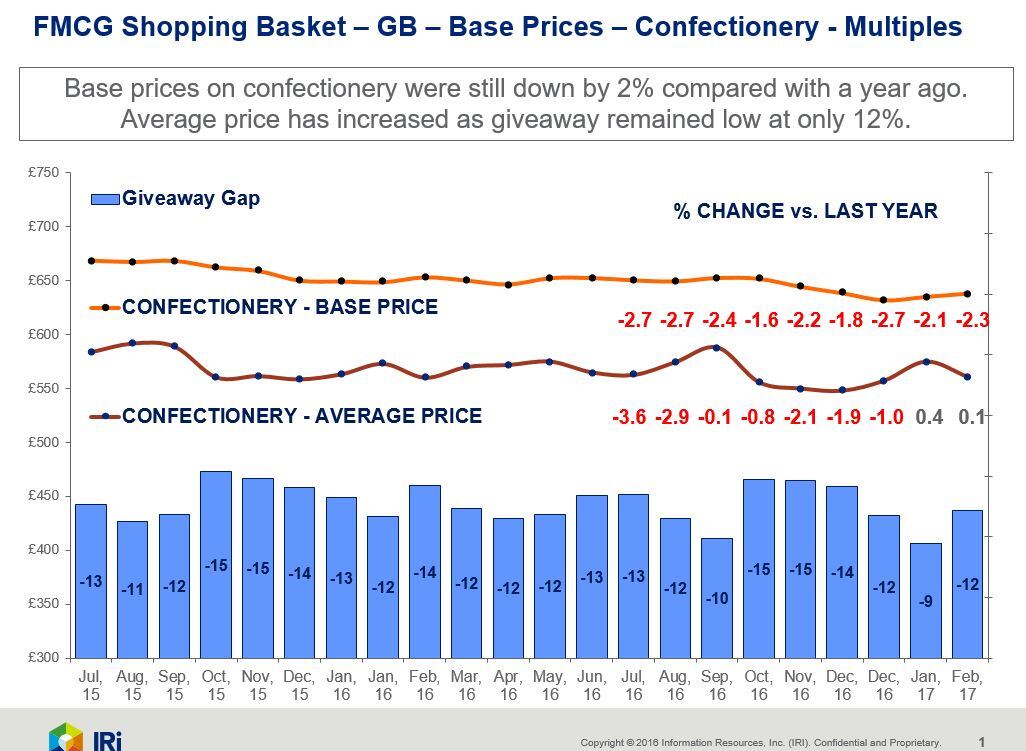

Confectionery base prices – which are retail prices per unit excluding promotions – were down -2.3% in February 2017 compared to the same month last year.

Confectionery base prices have fallen between -1.6% and-2.7% every month year-on-year since July 2016. This comes despite fewer trade promotions.

"We're just not seeing this serious Brexit effect currently - maybe it's still too early for that,” said Eales.

Gradual price increases

The analyst continued: "I think we will start to see more consistent price increases, but I think they will be slow to come.”

He said exchange rates combined with price fluctuations in raw materials, wages and fuel prices will eventually push grocery prices up.

Impact of sugar reduction on pricing

Public Health England (PHE) last month urged chocolate and sugar confectionery makers to cut sugar by 20% by 2020, including a 5% reduction in the first year.

What impact will this have on retail prices for confectionery given that reducing portion sizes is the preferred option?

"I would anticipate that will increase the price per kilo of chocolate to the consumer - the portion sizes will get smaller but the prices will either stay the same or not go down as much as the portion size does,” said IRI’s Eales.

He said Easter egg sizes in the UK this year, for example, were smaller while prices were largely unchanged.

"It is going to be a very slow process...I would be surprised if we reach more than +3% for total food prices in the next year,” said Eales.

He added that confectionery manufacturers may find wholesale price increases tough to push through to retailers in a very price competitive retail landscape.

Chocolate prices low as cocoa market poised for surplus

Chocolate base prices fell -3% in the last eight weeks compared to the same period last year, while sugar confectionery base prices dropped -0.5% and gum prices remained static, IRI data shows.

Lower chocolate retail prices come as prices for cocoa bean prices reached a three-year low in February, according to the International Cocoa Organization’s monthly averages of daily prices on the main exchanges.

The global cocoa market is set to record its largest surplus in six years for the current 2016/17 season with production up 15% year-on-year driven by favorable weather in top origin nation Côte D’Ivoire, commodity analysts Mintec said last month.

Mars and Mondelēz hint at price hikes

But major UK chocolate producers have warned of impending price increases.

UK chocolate market leader Mondelēz said in January it would increase prices on select products such as Freddo bars.

It cited increased commodity costs – namely cocoa – and foreign exchange pressures.

Fiona Dawson, head of Mars’ food business, said last month that, unless the UK secures a favorable trade deal with the EU after Brexit, consumers could expect higher chocolate prices.

UK trade body, the Food and Drink Federation (FDF), told us in January that input costs such as packaging materials and the devaluation of the pound would eventually lead to increased retail prices for confectionery.

Resilient UK chocolate exports

Chocolate is the UK’s second largest food and drink export behind whiskey. Chocolate exports were up 2.7% in volume and 13.6% in value to £663.4 ($851m) in 2016, according to recent data from the FDF. The EU accounted for 71.4% of UK food and drink exports last year.

Outlook for confectionery

Euromonitor projected in June 2016 that confectionery would be the worst hit packaged food category after Brexit as consumer cut back on discretionary items.

It predicted a compound annual growth rate (CAGR) decline of -0.2% in volume sales for UK confectionery from 2015 to 2020.

IRI data for the 12 weeks up to February 25, 2017 show UK chocolate value sales were down -2.2% with volume sales dropping -2.3% compared to the same period last year.

UK chewing gum value sales dropped -5.3% and -3.8% in volume, while UK sugar confectionery value sales fell -0.1% and -0.3% in volume over the same period.

"Given the sugar reduction impetuous from the government, [volume sales in the next five years] will show some decline," said Eales.