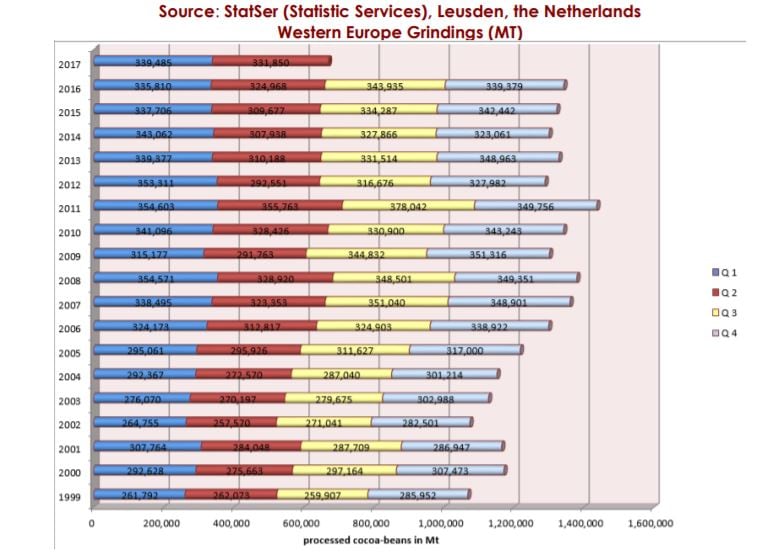

The Q2 grind in Europe grew 2.1% compared to the same period last year to 331,850 metric tons (MT), figures released today by the European Cocoa Association show.

The data was compiled from 21 cocoa bean processors including Barry Callebaut, Cargill, Nestlé and Mondelēz in the 15 original EU countries as well as Switzerland.

Improved cocoa ratio

Laurent Pipitone, director and co-founder of Economic Development Insight, told ConfectioneryNews the rise was in line with expectations.

"Grindings in Europe were not that good last year, but the main reason is the improvement of the cocoa butter ratio."

The combined cocoa ratio is the price of cocoa butter and cocoa powder at European factories relative to the futures price for cocoa beans on the London market. The ratio impacts profitability for cocoa processors.

The world’s top cocoa grinder, Barry Callebaut, last year said the cocoa ratio was harming its H1 2016 profits in its cocoa ingredients division as it began phasing out less profitable contracts for cocoa ingredients such as butter, powder and liquor.

“The combined ratio cocoa butter/powder is now over 3.5, which means processing is now quite profitable and that's mainly due to the very low bean price,” said Pipitone, formerly director of the International Cocoa Organization’s (ICCO’s) economics and statistics division.

Cocoa prices expected to remain low

Cocoa prices plummeted to a four-year low earlier this year. A ton was trading for just $1,931 on July 7, according to the ICCO's average of the three futures trading markets.

Germany cocoa processing declines

German confectionery association BDSI said cocoa processed in Germany during Q2 declined -2.94% compared to the same period last year to 87,849 MT.

Pipitone expects prices to remain low in the next cocoa year (October 2017 – September 2018).

"Many farmers in Africa have the feeling this year was exceptional and it was a bad year for them, but unfortunately the most likely scenario is that prices will remain low next year,” he said.

Chocolate market not ‘very buoyant’

Pipitone continued: "The chocolate market has not been very buoyant in the past few years - the economic crisis has had an impact on the global chocolate market.“

The German and US chocolate confectionery markets posted -1% compound annual growth rate (CAGR) in volume sales over 2011-2016, while volume sales were relatively flat in the UK and France, according to Euromonitor International data.

This came despite a rise in value sales over the same period (2011-2016) in all these markets driven by premiumization.

Pipitone said declining cocoa prices may have a positive impact on the chocolate market. "That may help consumption to rebound a bit and come back to the growth trend before,” he said.

He added that chocolate consumption in India and China continues to rise, albeit from a very low basis.

Africa cocoa processing may pick up

The full year EU cocoa grind is set to grow 0.8% based on moving averages. ECA will report Q3 figures in October this year.

The US National Confectioners Association (NCA) will publish North America Q2 cocoa grind data next Thursday (July 20).

The Cocoa Association of Asia expects to release Asian cocoa processing numbers for Q2 next Wednesday (July 19).

Pipitone expects the grind to rise in Asia.

ICCO full year (Oct-Sep) 2016/17 forecast - 000's MT

World Production: 4,692 +18.1%

World Grindings: 4,263 +3.2%

Surplus: +382

He also predicts African cocoa grindings, particularly in Côte d'Ivoire and Ghana, will pick up in Q2, after a poor crop following El Nino impacted bean quality last year.

Africa has accounted for around 20% of global grindings in the past three years, said Pipitone.

Record high surplus for 2016/17?

"This year has been an excellent year for production," Pipitone continued.

He expects a record global cocoa production surplus for the current crop year 2016/17 (Oct-Sep), which he predicts will be even higher than the ICCO's 382,000 MT forecast.

"Next year, I don't expect production to reach the same level. The weather conditions are not as good as for the last main crop, so I expect a reduction, but that does not mean we will have a deficit.

“It's still highly probable we'll have a surplus of production next year,” said Pipitone.