Van de Put is currently president of McCain Foods, a $7.3bn privately held Canadian company that manufactures frozen French fries. He has also held senior positions at Mars, Danone and Coca-Cola.

Rosenfeld will continue as chairman of the board until March 31, 2018, at which point she will retire and Van de Put will assume the role of CEO and chairman.

The announcement follows Mondelēz's decline in Q2 revenues.

Commenting on Dirk Van de Put's new position, Rosenfeld said, "I’ll be cheering loudly from the sidelines as a sizable shareholder."

Retirement plans

The Wall Street Journal broke the news earlier this year that Mondelēz was looking for a successor to Rosenfeld, to which the Oreo cookie maker responded it had processes and plans in place for all executives, and “that’s simply good governance.”

However, Rosenfeld’s comments during the company's 2017 Q2 financial earnings revealed her retirement plan has been proposed several years ago.

“Over the last couple of years as I talked with the board about my plans and my timeline for retirement, they put in a place a very thorough multiyear process,” she said. “And in that process, the board considered both internal and external candidates…

"I’m very pleased with the choice of Dirk," said Rosenfeld.

Her departure follows Mondelēz’s failed attempt to take over Hershey and "comes amid stagnant organic sales growth as consumers reach for healthier options over processed foods," according to Euromonitor analyst Pina Hosafci.

“Mondelēz will [probably] follow the big flurry of other FMCG giants, such as Nestlé and Unilever, who are undergoing massive cost reductions, especially in the areas of personal cuts and operational management, perhaps even advertising - one area that Rosenfeld was completely against," she said.

Rosenfeld joined Kraft Foods as CEO in 2006 before the company changed its name to Mondelēz following a spin-off of its grocery business in 2012. She also helped the acquisition of Cadbury during her tenure.

Revenue decline caused by cyber attack

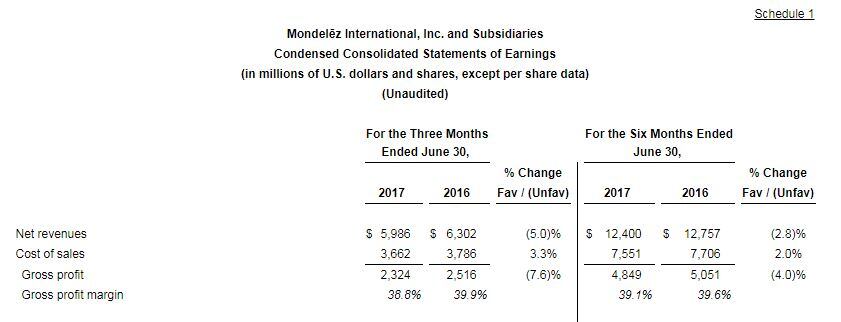

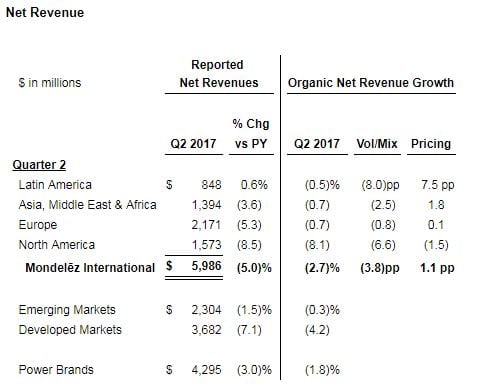

Last month, the company reported its second quarter net revenue had decreased by 5% to $5.99bn, while organic net revenue declined 2.7%, mainly caused by the malware incident at the end of June.

“We experienced meaningful disruption in our ability to ship and invoice during the last four days of the quarter. As a result, our Q2 organic net revenue growth was negatively affected by approximately 2.4 percentage points (equivalent to $140m),” said Rosenfeld.

“While we’re not back to normal, we expect to recover the majority of these delayed shipments in the third quarter.”

Brian Gladden, Mondelēz’s CFO, also noted North America was most impacted by the malware incident, but believed it would not have any long-term impact on its customer relationships or market share.

Gladden added that North America was also the market where Mondelēz lost the majority of its consumption due to the timing of the July 4 holiday. Organic net revenue from North America declined by 8.1% during Q2.

Despite the cyberattack, Mondelēz’s global e-commerce net revenues continue to grow by 30%.

Unchanged outlook

Rosenfeld said Mondelēz is seeing some “green shoots,” despite soft Q2 results.

“Our white space chocolate expansion gains in displays and shelf space as we capitalize on our competitor’s transition out of its DSD (direct store delivery) network,” she said.

Mondelēz’s outlook remained unchanged for the full-year 2017 with its organic net revenue targets at least 1%.

Category growth

- Snacking: 1.5%

- Chocolate: 5%

- Gum and candy: -7%