It claims it is proving companies can produce affordable chocolate, free from unlawful child labor, for a strong profit.

However, the company is so far selling mainly in natural and specialty stores and does not yet directly compete with America's leading firms Hershey and Mars.

"Our goal is to move into more conventional accounts to show we can do this in the same playing field as the large chocolate companies," Peter Zandee, US sales manager at Tony's, told ConfectioneryNews.

Tony's has started selling to some Safeway stores and will enter Raley's Supermarkets on the West Coast this winter.

$50m revenues forecast for 2017

The Amsterdam-based company was founded in 2005 by Dutch journalist Teun (Tony) van de Keuken, who investigated forced labor on cocoa farms and West Africa.

He sought to prove chocolate could be produced without unlawful child labor and established Tony’s as a model for larger companies to follow.

The company - privately-held by four parties - predicts $50m in worldwide net sales for fiscal 2017 (ending September 30, 2017) , representing +44% year-on-year growth.

Tony’s in America

The for-profit B-Corp entered the US market in October 2015 with a listing at New Seasons Market in Portland, Oregon, where Tony's US office is based.

The US launch was initially planned for Fall/Winter 2014, but was delayed by a year as Tony’s was struggling to source enough cocoa according to its strict guidelines, while demand for its brand grew in Europe.

Tony's gets seasonal

Tony’s recently launched a 6.35oz (180 g) limited edition mulled wine chocolate bar in the shape of a Christmas tree in the US that can be used as a decoration. It will be available at Earth Fare, Fresh Thyme Farmers Market, NCG Co-op, New Seasons and Nugget Markets for a suggested retail price of $5.49. The company intends to launch a Valentine's bar and Easter eggs for the US market next year.

Today Tony's has US distribution in Whole Foods, The Fresh Market and Kings Food Markets among others and expects US revenues will grow +400% this fiscal year, albeit form a low base of €504,000 ($598,000) in fiscal 2016.

America is Tony’s largest international market, followed by Belgium and Sweden.

"The reason to enter the US market was less commercial and more driven by our mission [for 100% slave-free chocolate]," said Zandee.

Three of the five largest chocolate companies in the world - Hershey, Mars and Mondelez are based in the US - and Tony's hoped to show these companies profits are still possible by adopting the Dutch firm’s cocoa sourcing model [Description below].

Larger bars and potential for a US factory

"The US is a very different market to what we saw in Europe," said Zandee. "It's much more fragmented - there's way more competitors, and way more chocolate companies that play in the ethical space."

The US sales manager said Tony's bars (6 oz) are twice as large as the usual US chocolate bar (2.8-3 oz) and retail for around $4.99.

Around nine months ago, Tony’s introduced four smaller bars (1.7 to 1.8 oz) for a suggested retail price of $1.99, making it a cheaper option in the natural and speciality channel.

The company grew rapidly across the Pacific Northwest from 2015 and later expanded distribution to California and to other US states. "As of this month we are national," said Zandee.

Tony's bars for all its markets are produced by two contract manufacturers in Belgium.

"We are not actively looking to move production for the US to the US, but it is in our planning to start producing here once we grow further,” said Zandee.

Tony’s cocoa sourcing model

Tony's sources its global cocoa needs from 7,000 farmers across six cooperatives in Côte D'Ivoire and Ghana.

It has a five-pronged approach to cocoa sourcing that it hopes larger companies can adopt:

Tony’s has five-year supply deals with its cooperatives, which is longer than the industry norm.

"The idea of signing long-term deals with the farmers is that it creates stability in our supply chain," said Zandee, adding Tony's could work directly with the farmers to improve productivity and cocoa quality.

"It also helps them [the farmers] because it takes away the uncertainty of the market they otherwise face to sell their beans," giving them greater incentive to invest in their farms, he added.

Premiums double that of certification

Tony's buys cocoa butter from Barry Callebaut, which has established a traceable cocoa supply chain for Tony's, for which it pays an extra cost.

"We know exactly where our beans come from. And once we know where they come from we can work directly with farmers and pay them more,” said Zandee.

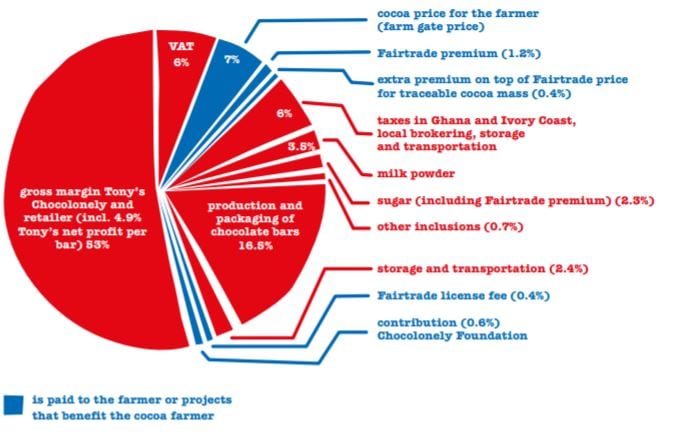

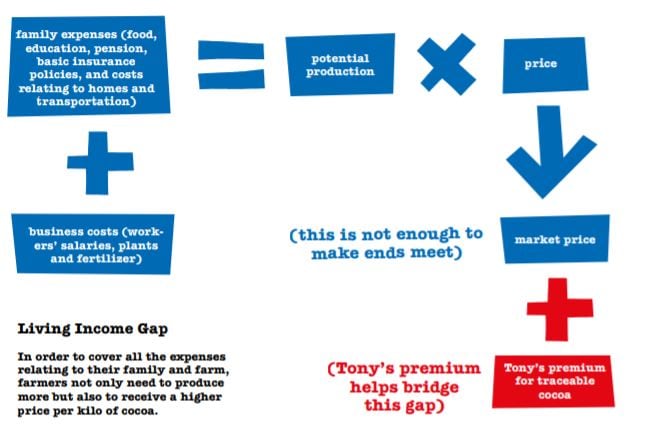

Tony's pays a 20% premium on top of the world market price for its cocoa, which averaged $375 per (metric ton) in fiscal 2015/16.

This includes a $200 per MT for the beans, which are also certified by Fairtrade International. Its sugar is also Fairtrade.

Tony’s total cocoa premium is more than treble the premium of leading certification program UTZ, which averaged €89 ($106) per MT in 2016.

Tony's premium is based on its own calculations for a living wage for farmers in Côte d’Ivoire and Ghana:

Working with Barry Callebaut

But why does it work with the world's biggest chocolate manufacturer Barry Callebaut when it alleges the industry has historically been complicity in cocoa slave labor?

A premium for traceability

Tony's is paying more to have a traceable cocoa butter supply from Barry Callebaut. Supply chain advisor The Forest Trust has urged chocolate manufacturers to push suppliers to make traceability the norm without extra cost. It argues eliminating illegal practices like unlawful child labor is only possible with traceability and says it should be included in existing supply deals.

"It would have been easier for us to import our own beans and process them, but it doesn’t really create a system that works for larger chocolate companies,” said Zandee.

"All large chocolate companies work with chocolate processors like Barry Callebaut. In working with Barry Callebaut we can show we can do this within the industrial supply chain," he said.

Tony's does not centrally ferment and dry its cocoa - this is done at farm level. Zandee said the coops supplying Tony's have child labor monitoring and remediation systems (CLMRS).

Child labor prevention

Tony’s mantra is for '100% slave-free chocolate'. It aims to eliminate the 2.03m Ivorian and Ghanaian children engaged in hazardous cocoa work, identified by Tulane University in the 2013/14 harvest season.

"I don’t expect these numbers will become better anytime soon until companies really start to make a bigger effort,” said Zandee.

The USA sales manager said Tony’s is unconcerned by children helping out at cocoa farms, but when they engage in hazardous cocoa work such as lifting heavy loads or are exposed to agro-chemicals this falls within the International Labour Organization's (ILO) definition of slavery.

"Our goal has always been to show the other chocolate companies it is possible to create chocolate at a reasonable price without the use of illegal child labor.

“We want to show this to all the big chocolate companies. In order to do so we need to prove we can make a profit…Our profit margin goal is 4%."

Tony’s net profit of €1.4m ($1.7m) was at 4.9% of its revenues in fiscal 2016 versus 4.1% the previous year.

Profit margins at large chocolate firms vary. Hershey's 2016 profit margin was 9.7%, but this is for the total business, which sells goods other than chocolate.