The market data provider conducted a survey for its latest report ‘Clean Label in Confectionery: Influencing Ingredient Inclusion', which found 29% of respondents in 21 countries considered natural products healthier than non-natural items.

“...Clean label’s promotion of natural ingredients is leading to an association with health, which can vindicate purchases," said Euromonitor.

“In location terms, clean label confectionery claims are widespread in developed markets, where consumer awareness of ingredient usage has grown substantially in recent years,” it added.

Growth of clean label confectionery

Euromonitor said confectionery has been “at the forefront of the transition to clean label products” in recent years.

Its data showed the retail value of the global clean-label confectionery had grown from $10.38bn in 2015 to $10.57bn in 2016. In the chocolate category, clean label’s retail value had grown from $3.78bn in 2015 to $3.83bn in 2016, while gum and sugar confectionery segments also saw growth during the two-year period.

John George, ingredients consultant at Euromonitor, suggested clean label in confectionery is usually associated with the removal of artificial flavors and colors, and preservatives.

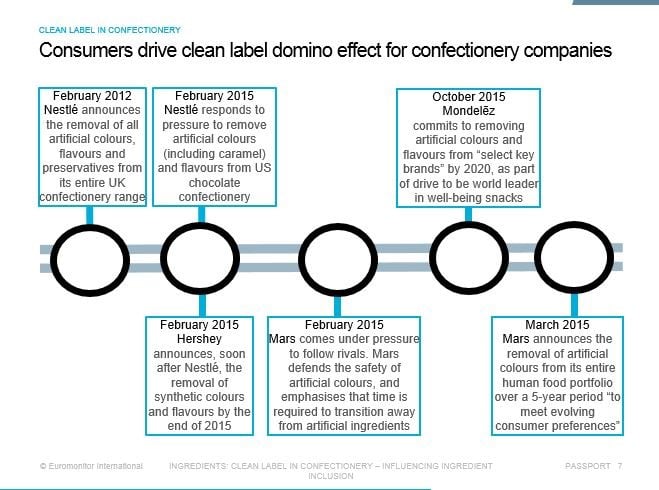

Nestlé, for example, previously removed all artificial ingredients from its entire UK confectionery range and US chocolate in 2012 and 2015 respectively. Hershey, Mars and Mondelēz followed suit around the same time.

“These changes were first driven by legislation, and more latterly have become necessary to match the changes made by competitors,” said George.

Removing artificial ingredients is not enough

Even though the chemical composition of artificial flavors is perceived badly by consumers, natural flavors are coming under scrutiny too as they are made with dozens of ingredients, he said

“The alternatives to additive flavors are foodstuffs and botanicals, which can be marketed as providing an unadulterated flavor… this is most clear in Western Europe and North America, with use of food and beverage flavors in confectionery declining, but botanical inclusion growing slowly,” he explained.

However, simply removing artificial ingredients may no longer be enough to tap into the clean-label confectionery trend, George said.

“Empty calories are increasingly unacceptable, so there are likely to be more raw confectionery launches, increased use of additional healthy ingredients, including superfoods and ancient grains, and greater attention paid to the health benefits of cocoa.”

As for developing regions where confectionery consumption is increasing, it is not worth sacrificing taste for clean label, George added.

“Flavors are still sought in developing regions… where the value of clean label has not been fully established,” he said. “Taste is a key determinant of consumer purchases.”