Three major cocoa processing regions, Europe, North America and Asia, reported increases in cocoa processing during July-September 2018, a sign that the industry is still optimistic about future demand for chocolate products.

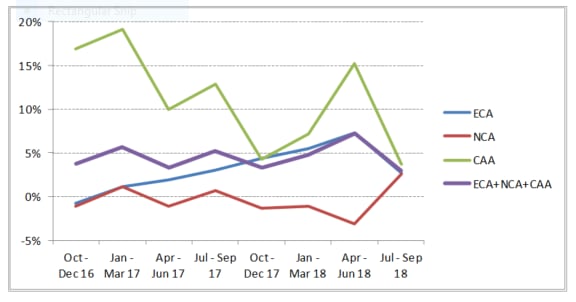

Recent data published by the European Cocoa Association (ECA) showed that grindings in Europe increased by 2.7% in the third quarter of 2018 compared with the same quarter in 2017. The National Confectioners’ Association (NCA) reported that grindings in North America (Canada, Mexico and the United States) rose by 2.5% while the Cocoa Association of Asia (CAA) reported an even stronger increase of 3.7%, in Malaysia, Indonesia and Singapore. These three regions account for about 60% of world grindings.

Processing margins and processing volumes have been strong for the past two years, following a less favorable period in 2015 when processors were below their breakeven point. The International Cocoa Organization (ICCO) estimated that global grindings rose by 6.5% in 2016/17 and by 3.9%1 in 2017/18 and data from KnowledgeCharts show that processing margins have been steadily increasing since January 2016 until recently.

There are good prospects for further expansion of cocoa grindings in the current 2018/19 season, albeit at a slower pace than in the past two years. New investments in processing factories are expecting to add capacity but this, in return, will put pressure on the price of cocoa semi-finished products and on margins.

[1] This figure may be revised slightly upwards due to recent information made available