Cocoa origin claims on chocolate products are rare and at odds with the main sourcing regions of cocoa, a study from Lumina Intelligence has revealed.

Lumina’s analysis of 1,000+ chocolate products across 20 countries sold online shows only 11% of chocolate brands indicate a cocoa origin. Claims in tea and coffee are much more common.

It also found that products making a cocoa origin claim attract a 51% higher price and higher average star rankings in the growing online retail space.

The single-origin term in cocoa is used when beans come from one specific place or origin and the beans take on the characteristics of the ‘terroir’ or region where it is grown, similar to wine.

“The focus for us was always on the origin, because if you have chocolate that’s not blended it is similar to wine, but every origin is different based on the soil, the weather conditions and it has been really hard work partnering with small holders on this,” Christina Franken from The Travelling Frenchman, told ConfectioneryNews.

Blockchain

Traceability technology and the use of Blockchain is providing companies with more of the data regarding the origins of cocoa than ever before, consumers are also demanding to know where their food comes from and recent regulation in the EU and Australia suggests the global regulatory environment is gradually compelling companies to reveal more about ingredient origins.

Lumina’s Origins report makes a case for creating premium chocolate lines tied to geographic provinces (e.g. Amazon's chocolate) to drive sales and sustainability.

This report explores how industry can communicate the story of cocoa’s origins credibly and to the benefit of farmers. The research team assess if creating a market for cocoa origin chocolate has potential to support sustainability efforts.

Analyst Oliver Nieburg said: “Supermarket shelves stocking dark chocolate divided by cocoa origin – like a fine wine aisle – are perhaps far off. But e-commerce may make it easier to create unique clickable sections dedicated to chocolate with cocoa from ‘Ecuador’ ‘Madagascar’ or ‘Brazil’ or a direct-to-consumer origins chocolate brand akin to Nespresso’s Master Origin coffee range.”

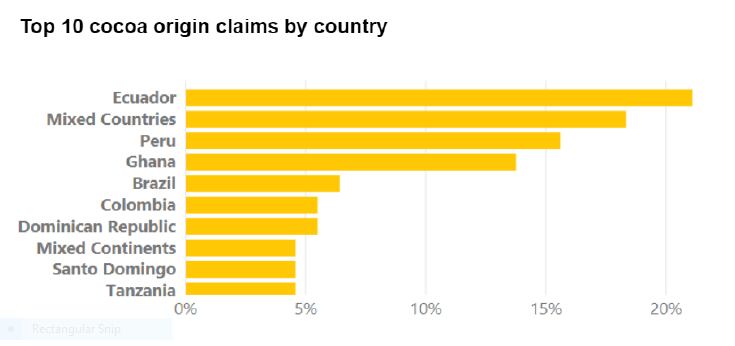

He sees Ecuador, which attracts the most cocoa origin claims, as one of the pioneers in cocoa origin labelling. ConfectioneryNews reported last year that Kallari Chocolate, an Ecuadorian cocoa farmer group that also produces branded chocolate, is to open a chocolate factory near its plantations in Tena this year.

A spokesperson from the Ecuadorian Ministry of Production, Foreign Commerce and Fisheries told Lumina: “Many cocoa producers from other latitudes would like to be identified with our grain, that's why, the national government, in a major effort, is identifying and certifying all cocoa and chocolate that meets the expectations that reflect the differentiated quality of Ecuadorian cocoa and chocolate, so, that way, the farmers will get a better price for their cacao and secure their market.”

Whether cocoa origin claims can support sustainability efforts is another angle covered in the Lumina report. Ecuador definitely sees prospects for farmers to benefit, while the International Cocoa Organization (ICCO) says cocoa origin claims are currently a marketing concern, but could aid sustainability as traceability grows, it states.

Certification and traceability

“Concerning the potential benefits of origin labelling, of course this will become easier as emphasis on certification and traceability grows within the sector. This would imply that sustainability would benefit from this practice, but we are not aware of any evidence of this,” an ICCO spokesperson told Lumina Intelligence.

What does become clear after reading the report is that the online environment provides a wider canvass to communicate ingredient origin information and sustainability efforts than the confines of packaging.

Lumina’s analysis finds only 1% of chocolate products communicate a cocoa cooperative, farmer group or estate. It says its intelligence shows such government-led initiatives could lead to more chocolate brands making cocoa cooperative claims on pack.

The IDH (The Sustainable Trade Initiative) is running a Cocoa Origins programme to support the Dutch government’s aim of 100% sustainable cocoa consumption on the Dutch market by 2025 and intended to allow farmers and cooperatives to contact small volume chocolate makers in the US to conduct direct trade. This means the chocolate maker would deal with the farmer group directly and develop a relationship rather than buying couverture from a supplier. The program, funded by Ministry of Agriculture, Nature and Food quality will run until the end of 2020.

Sako Warren, executive director of WCFO, says: "In South America, we have cooperatives who are benefitting [from their name appearing on chocolate products], but not to the extent chocolate makers are claiming. In Africa, we don't have any evidence cooperatives are benefitting."

Companies such as Ferrero (by 2018), Cargill (by 2030), Olam (by 2025) and Nestlé (80% by 2020), are committed to full cocoa traceability, according to the Lumina Sustainability Commitments Database, which raises the prospect of origin communications that attract a price premium.

To sum up, Lumina Intelligence believes direct trade and increased traceability can create more value for the cocoa market, but stakeholders must ensure farmers also benefit, providing supporting evidence.

Lumina Intelligence

Lumina Intelligence is an insights business, by William Reed providing an insights service for industry, governments and NGOs, including information and data on cocoa, coffee and tea sustainability.