A new sustainability report from Lumina Intelligence,'Up to standard: Third-party certification and company programs compared’, has discovered that price-sensitive consumers are failing to engage with sustainable brands in chocolate, coffee and tea markets ‘awash with claims online’.

Instead, they are favoring mission-led brands like refugee-supporting Nemi Teas over the ‘biggest firms that may be shouting loudest about their ethical credentials’, the report discovered.

The report has analyzed the sustainable claims of 2,800 chocolate, ground coffee and tea products in 20 countries, along with the contribution to sustainable development of each claim.

Tackling transparency

The report found 28% of the bestselling chocolate, coffee and tea products online make sustainable claims in these countries. It noted the marked shift from much-criticized third-party certification labels to inhouse programs in recent years - but claimed many of these initiative ‘often lack transparency in proving their sustainability contribution’.

“The spearhead of sustainability of the last 30 years – sourcing certified volumes – is fighting to prove its worth as companies shift to self-managed sustainability programs,” said Lumina analyst Oliver Nieburg.

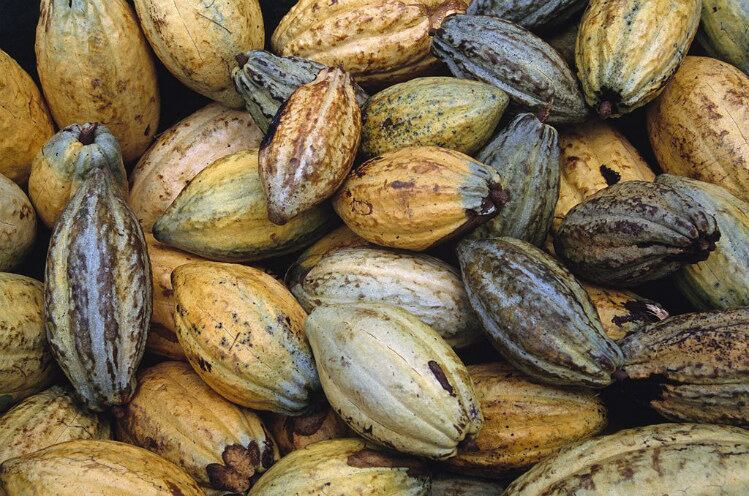

Organic and Fairtrade are the most common third-party certification claims on chocolate, coffee and tea products, followed by the Rainforest Alliance and UTZ, with Nestlé’s Cocoa Plan and Mondelēz’s Cocoa Life the most popular corporate schemes.

A spokesperson for Fairtrade told ConfectioneryNews: “As the report ‘Up to standard’ points out, there are an increasing number of sustainability labels on the shelves, representing at least as many different claims. Achieving a better deal for farmers and workers in developing countries has always been, and always will be, at the heart of Fairtrade's mission.

“The report echoes other market research – commissioned by Fairtrade and others such as Eurobarometer – which has shown that, in some of the largest markets in the world, Fairtrade is the most recognized and trusted ethical label. Fairtrade’s rigorous standards, the Fairtrade Minimum Price and Premium, and independent third party verification through FLOCERT [the global certifier for Fairtrade] contribute to this, as does transparency in sharing our standards, data and research.

“For instance, last year we started reporting how producer organizations spend their Fairtrade Premium funds in support of the SDGs. Fairtrade is itself a member of the ISEAL Alliance, which sets standards for sustainability certification schemes.”

Products carrying sustainable claims are on average 6% more expensive, said Lumina, but price-sensitive consumer engagement with these brands (by review volumes and star ratings) is typically low in online retail spaces.

“These company programs could be impactful but are often shrouded in secrecy. A nebulous mesh of sustainable claims has emerged on products and online, leaving chocolate, coffee and tea consumers struggling to understand what is fair,” said Nieburg.

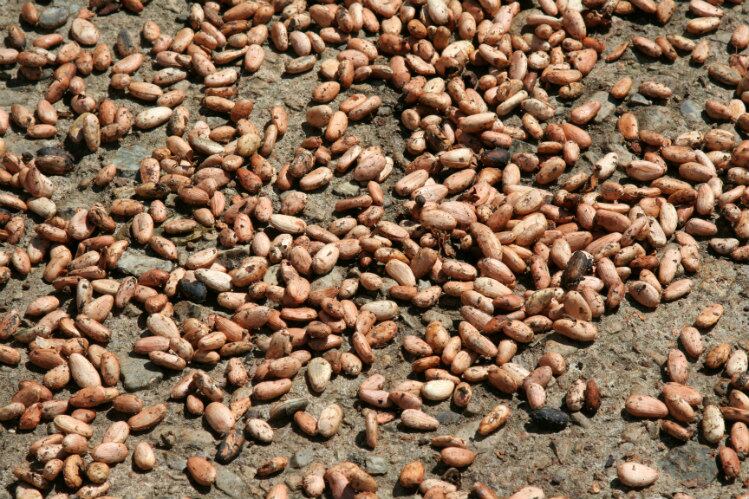

Rainforest Alliance - through its merger with UTZ - is by far the most dominant third-party certification programme within cocoa, with 1.96m metric tonnes (MT) produced as certified combined in 2017, the report discovered. It said Fairtrade had yet to publish 2017 figures at the time of compiling the report, but cited production of 291,917 MT in 2016.

Cocoa Life

Mondelēz International is the company generating the highest average reviews for its brands with sustainable claims among the global top six, the report found, saying: ‘This is mainly due to the strength of its products carrying Cocoa Life claims’.

Cathy Pieters, director of Mondelēz International's the Cocoa Life program, told ConfectioneryNews: “Our global cocoa sustainability program Cocoa Life is dedicated to making an impact across the entire cocoa sector, and we hold ourselves accountable for creating real change in cocoa-growing communities.”

She said Cocoa Life uses FLOCERT and Ipsos (third party research agency) to independently verify and measure its progress. “At Mondelez International, we believe in making snacks the right way, with respect to people and planet, which starts with the sustainably sourcing of our essential raw ingredients. Our purpose is to empower people to snack right and that starts with ensuring our snacks are made the right way.

“Verification provides transparency and enables us to quantify Cocoa Life’s impact on farming communities,” she said.

Certification challenges

The report also discovered that, while consumer engagement with corporate sustainability schemes is clearly partial at best, companies are upping investments with billions committed in the coming years and decades.

Much of this aligns with United Nations Sustainable Development Goal 12 Responsible Consumption and Production, but a lack of transparency around issues like farmer income, zero hunger, child labor and price premiums for farmers remains.

World Cocoa Foundation president Richard Scobey also responded to a CN request for a comment on the report: “We’ve come to recognize that certification is one way to make cocoa more sustainable, but by itself it will not end child labor and deforestation and provide a decent standard of living for farmers and their families.

“We have seen that the current model of implementation for certification, and associated premiums, has had limited impact in accelerating positive economic, social and environmental change, and the consumer premium for sustainably grown cocoa has not materialized. The industry is responding in two ways: firstly, it is working with the certifiers to improve certification. Secondly, in recognizing that certification by itself will not work, industry is taking a broader approach that integrates the various individual actions and actors – farmers, civil society, governments, private sector - into a more effective push to achieve a sustainable and thriving cocoa sector.”

Price and engagement

Lumina’s data capture revealed organic products carry the most significant price premiums across the board.

Greater engagement occurs for ethical brands with simple stories that can simultaneously reduce consumer price sensitivity, the report noted.

“Mission-led brands tied to an understandable social cause or ingredient origin are bucking the trend,” said Nieburg. “Certification standards will either evolve as standards above and beyond corporate sustainability programs or will exist with company programs as a minimum requirement,” Nieburg said.

Sustainable claim hotspots

Countries with the highest concentration of sustainable products tend to be European with France (57%), Belgium (53%), Sweden (45%), Germany (45%) and the UK (44%) leading the way, Lumina’s report revealed. The US comes in at 31%.

India and South Africa show the most promise among emerging among economies, the report found.

At the other end of the spectrum lie South Korea, Brazil, Mexico, Russia and China, where less than 10% of products carry sustainable claims online.

Nieburg said the report found a weak correlation between products with sustainable claims and higher online product ratings or more favourable reviews.

“Products making ethical claims tend to have lower review volumes than those with no claims, with organic-certified products having the lowest review volumes. This suggests a gulf between apparently desired ethical products and those in which shoppers actually purchase and engage."

A path forward

“Through Cocoa Life, we are leading the transformation of the cocoa sector. We do this by implementing our own holistic program in partnership with others, sharing what we've learned on the journey, and by advocating for policy change. We are creating a movement for lasting change, rooted in deep understanding, sector-wide collaboration and partnership. To deliver on our mission, one of our core principles is to increase transparency by connecting consumers to cocoa growers,” said Cocoa Life’s Pieters.

The report concluded by advising higher consumer engagement could be driven by a single label from a body like the International Organization for Standardization (ISO).

“The report suggests a path to ensure claims and standards are credible and contribute to sustainable development, where brands are profitable, farmers have a voice, and claims are understandable to the public,” said Nieburg.

Fairtrade said it does not pretend that certification alone is the answer to the systemic poverty and other challenges in global supply chains. “While there is a gap in what consumers may say they value and what they actually purchase, consumer interest in sustainability is growing. Transparency is key so consumers know what is behind the labels. More and more companies are working with Fairtrade, and existing partners continue to increase their commitments."

About Lumina Intelligence

Lumina Intelligence Sustainability provides insights on the sustainable sourcing of cocoa, tea and coffee – three commodities facing similar social and environmental challenges.

Its subscription service helps companies, suppliers, NGOs, governments and academics strengthen programs, target research efforts and gauge demand for ethical products among online consumers.

email info@lumina-intelligence.com for more information