The need for alternatives that taste good, while also being natural, clean label and inexpensive is high, and with mounting pressure from public health initiatives, sugar technologies and food retailers are required to innovate and develop new product lines.

A specially convened summit in Chicago later this month will gather R&D, product development, and innovation leaders to discover the latest sugar reduction technologies and Alternatives. Topics will include understanding the cost of natural sugar alternatives, creating label-friendly products, improving taste and mouthfeel, and discovering the latest in fermentation.

Food and beverage products with sugar reduction claims have grown 13.5% annually over the past five years. Leading the way are natural sweeteners as consumers prefer plant-derived ingredients over artificially produced sugar substitutes -- Tom Fuzer, VP of Market Strategy at HOWTIAN

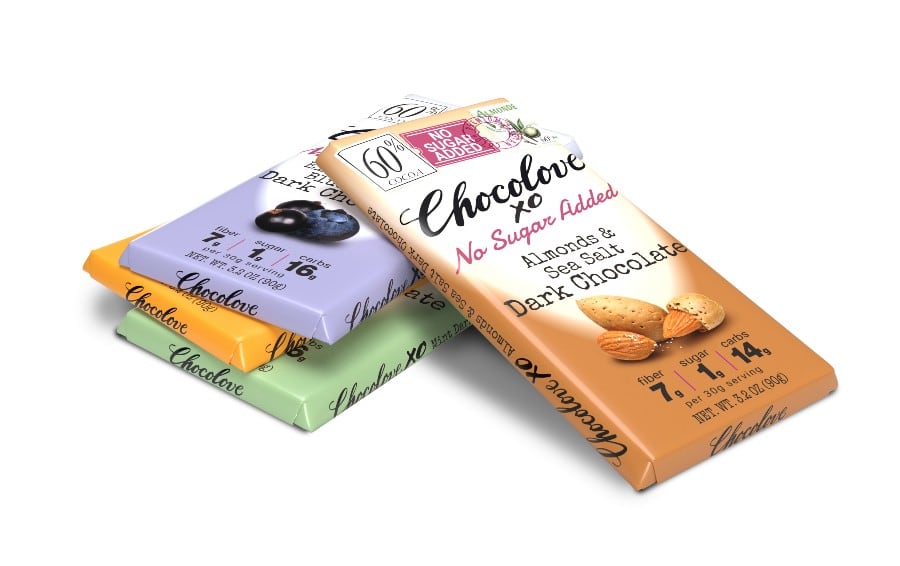

It’s a timely event as sugar reduction in confectionery is not going anywhere and is here to stay. Watch out for more smaller portions in the coming years as companies continue to develop smaller pack sizes containing 200 calories or less, which allows consumers to make informed choices when they are ready to treat themselves to their favourite snack or candy.

Sugar reduction has been a major trend even before the pandemic with consumers identifying reducing sugar intake as their top dietary focus with weight management a priority.

Health

The focus on healthy sweets means many innovative companies are striving to make their products ‘sugar-free’ by using alternative processes and nature’s own sweet solution to keep candies tasting wonderfully indulgent without the guilt factor.

The health risks of added sugars in confectionery are well known, but can sugar substitutes offer a credible solution when it comes to taste and mouthfeel?

There are a variety of methods for successfully replacing sugar in confections and replicating its properties beyond sweetness, says Tom Fuzer, VP of Market Strategy at HOWTIAN, the world’s largest manufacturer of natural stevia leaf extracts, “One we've found particularly essential is the use of a bulking agent to supplement natural sweeteners and maintain the size of the candy. Natural bulking agents, such as erythritol, allulose, soluble fiber and in my opinion, are also often needed to provide a similar mouthfeel or chew.

“Many bulking agents are less sweet than sugar. We recommend high potency sweeteners like stevia and monkfruit be used in combination with bulking agents to offset the sweetness difference. Most of these sweeteners have a delayed onset of sweetness so the bulk sweetener also provides an upfront sweetness to better replicate the taste profile of sugar.”

Pandemic

Fuzer said following the pandemic, consumers’ relationship with food and beverage has also changed.

“As a consequence of the lockdowns in 2020 and 2021, the obesity epidemic worsened around the world, which in turn, led to a dramatic increase in interest in dieting and healthier nutrition. Innova Market Insights reports that over one-quarter of respondents limited sugar intake in hopes of boosting immunity, a clear response to the pandemic."

Although it started before the pandemic, the sugar reduction trend accelerated during Covid and Fuzer says research shows it is a trend that is here to stay.

“Food and beverage products with sugar reduction claims have grown 13.5% annually over the past five years. Leading the way are natural sweeteners as consumers prefer plant-derived ingredients over artificially produced sugar substitutes. For the first time ever, the share of consumers who check ingredient labels surpassed 60%. Clean label products with well-known, simple, and natural ingredients will win out in the long run.”

Trust

Furzer also told ConfectioneryNews another post-pandemic trend he is eyeing closely is how the public's declining trust in institutions like the government, media and large global corporations is impacting our industry.

“Consumers are expecting more honesty and transparency from product manufacturers and this is especially true for food & beverages. This means a rising demand for locally produced foods with clean farm-grown origins. When it comes to ingredients, natural sweeteners with a transparent, ethical narrative and with credible sustainability stories have become much more attractive.”

Environment

In addition to diet trends, stevia's rise has been bolstered by its environmental benefits, says Fuzer. Compared to traditional sugars and other sugar alternatives, growing stevia produces a significantly lower carbon and water footprint. As such, stevia is a sweetener of choice for many LOHAS (Lifestyles of Health and Sustainability) consumers.

Fuzer says his company believes the industry is adapting well overall to the needs and demands of the modern consumer.

Stevia

“One area where we see a need to improve is addressing some consumers' outdated perceptions of stevia. When Reb A was first introduced, the industry rushed to market with products that featured stevia but neglected to optimize for its taste profile.

“Formulations with high use of levels of Reb A, particularly the low purity grades, created bitterness, aftertaste and other off-notes that consumers now continue to associate with stevia.

“Since then, improvements in the taste of stevia have come a long way. In the past five years, minor glycosides such as Reb D and Reb M have been commercialized and taste much better than Reb A. The industry needs to take a look at reformulating with these better tasting glycosides, particularly in sugar-free formulas.”

He also said a common and positive feedback from customers is that HOWTIAN's own SoPure Stevia products taste more consistent batch to batch compared to other stevia suppliers.

“Since we have a vertically integrated manufacturing process and produce our own raw stevia extract, we're able to produce more consistency batch after batch. We have also been involved in several independent sensory panel evaluations that show our stevia to have the cleanest taste and the least bitterness when comparing products of the same purity level.”

Production

The confectionery processing equipment market is expected to reach $8.74bn by 2028 and the globalisation of the food industry and resultant customer accessibility to various international varieties of confectionery items will significantly affect the demand for sophisticated hardware.

An increase in demand for sugar-free and organic confectionery products is another driving factor behind the lucrative growth opportunities in the market, say Reports and Data, a market research firm based in India and the US.

Despite a favourable market scenario, the rising occurrence of diabetes in both the elderly and middle-aged population segments, and rising awareness about the ill effects of regular sugar consumption will pose a threat to the market growth of confectionery processing equipment, it warns.

By application, the soft confectionery segment holds the largest market share due to heavy consumer demand. The segment has witnessed many improvements in its production methods over the years to overcome problems such as gelatine degradation, and reformulation and will remain the largest application of confectionery processing equipment in the years to come.