On Monday (3 October), the UK Government reversed planned tax cuts for high-earners announced only days earlier in a ‘mini-budget’ that sent Sterling plunging to record levels.

Bethany Payne, a global bonds portfolio manager at Janus Henderson Investors, said: “In spite of a significant U-turn from the Chancellor, the currency moves have been fairly minor with sterling trading at similar levels to where it was on Friday and still just below the levels prior to the mini budget.”

With Sterling remaining weak, the Fairtrade Foundation is concerned that the sharp currency devaluation will ‘set back’ efforts to intensify action on the climate crisis, human rights and decent pay for farmers and workers who produce food for UK markets.

Tim Aldred, Head of Policy at the Fairtrade Foundation said: “The dramatic fall in the pound means more bad news for Fairtrade farmers and consumers. Additional exchange rate costs will land on fragile supply chains already struggling from the global cost of living crisis.

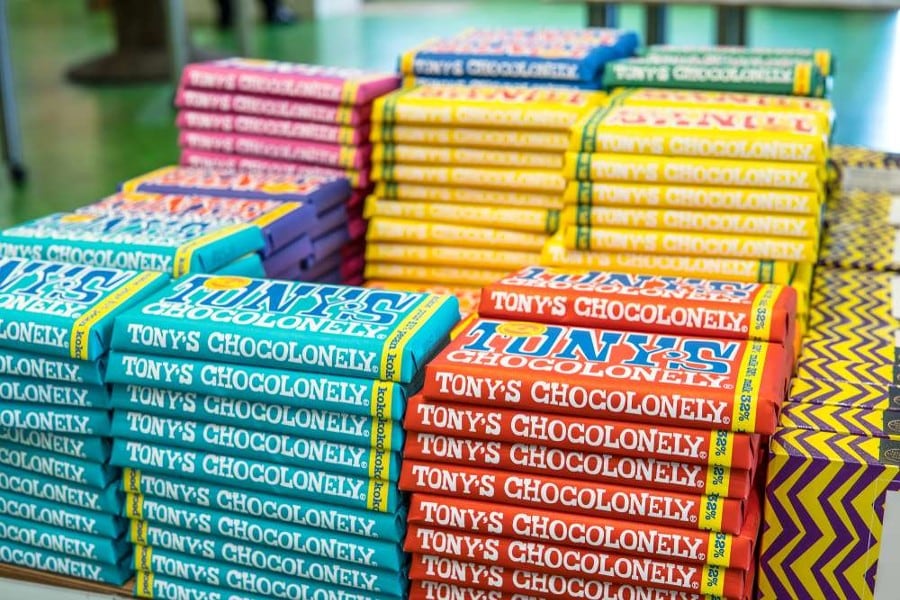

“Around 10-15 % of the UK’s food comes from Africa, Asia and South America, including key products such as cocoa, bananas and coffee. But many of these farmers and workers live in ‘in work poverty’, earning well below a living wage. The cost of living crisis provoked by war in Ukraine, climate damage and the continuing impact of the pandemic were already placing additional pressure on farmers.”

Aldred said if the end market does not absorb this new exchange rate hike, costs could be passed on to consumers or farmers.

“While Fairtrade farmers are protected from the worst effects through commitments to Fairtrade Minimum Price and Fairtrade Premium, they will still be hit by the overall market trend. Efforts to accelerate action towards living wages and living incomes, and to address human rights and climate challenges, will be set back,” he said.