Traders said the outlook for already poor crops in West Africa appeared to be deteriorating further. Some now believe the global deficit in the current 2023-24 season could be around 500,000 metric tons.

Emily Stone, founder and CEO of sustainable brand Uncommon Cacao, said: “We all know how the system works. We know that there will be a crash after the bull rally. We know how damaging this will be for producers.”

Market forces

- Prices for May New York cocoa CCc2 rose 4% to $6,505 a ton after setting a record high of $6,544 a ton.

- Prices for May London cocoa LCCc2 were up 4.2% at 5,572 pounds a metric ton at 1137 GMT after hitting a record of 5,579 pounds.

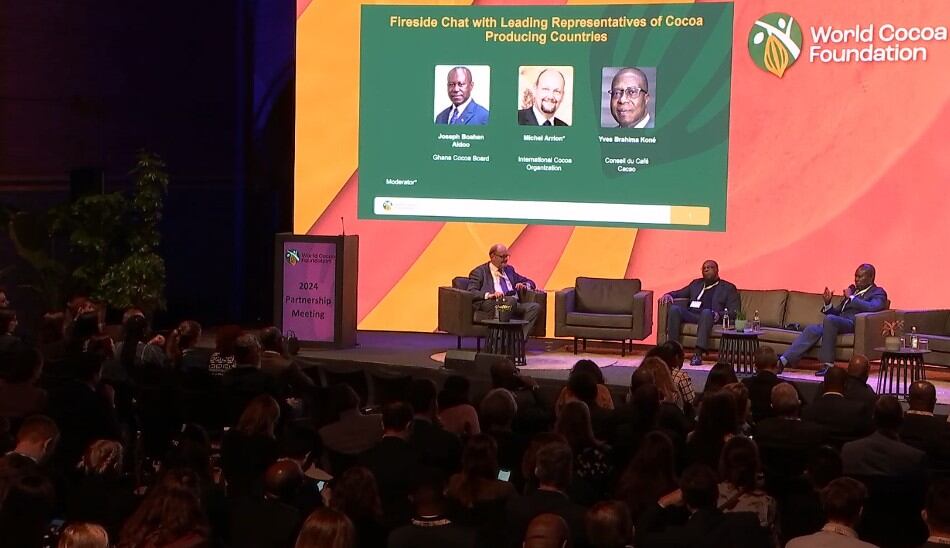

In its January 2024 Market Review, the International Cocoa Organization (ICCO) said as the leader in global supplies and processing, the Cote d’Ivoire’s regulator, Le Conseil du Café-Cacao, is reported to have taken steps to cater to the ongoing supply situation.

These include a halt on the 2024-25 forward sales and a restriction on cocoa processors keeping stocks beyond the set limits.

Structural issues

“There is a general view that the ongoing supply tightness originated from structural issues. In addition, concerns over the decline in supply could further deepen as the enforcement of the European Union regulation on deforestation draws closer. With the leading producer taking certain strategic steps (including a suspending of the 2024-25 forward sales and a restriction on stock limits), it would be beneficial if all major players reconsider the structural issues (aged trees, diseases, remunerative farm gate prices, climatic challenges, etc.) being faced by the cocoa sector,” the ICCO advised.

The Ghana-based cocoapost.com also reported that COCOBOD, the country’s cocoa sector regulator, anticipates a significant shortfall in cocoa output for the 2023-24 season, with a projected 40% deficit from the targeted 820,000 metric tonnes.

“Factors contributing to this decline include adverse weather conditions, smuggling, illegal gold mining, and the widespread prevalence of swollen shoot disease. During the previous 2022/23 season, COCOBOD reported a loss of approximately 150,000 tonnes of cocoa due to smuggling and illegal gold mining activities. The cocoa swollen shoot virus also ravaged around 500,000 hectares of cocoa farmlands.”

The regulator also said that "efforts are underway to address the problem. The rehabilitated farms will soon start fruiting, the rains have started, and we are seriously collaborating with the security agencies to arrest the smugglers," a source told Reuters.

"The ongoing seasonal intense Harmattan winds in West Africa are exacerbating the bullish prices situation," the ICCO also said in its report.

Latin America

It also warned that making up the shortfall in West Africa with beans from other regions, such as Latin America, will not ease supply pressures.

“Previous monthly reports have highlighted the issues that contributed to the challenges on the supply side in West Africa - the major outlet for global cocoa supplies. The Americas is the next main geographical area for global supplies. However, the region is currently not in a position and not an option to cater for the current shortfall, as the beans it produces attract a high premium and are expensive because of their fine flavour attributes.”

The true costs of modern cacao production, which have been ignored for decades, are coming home to roost. I think we may be looking at a hard reset for cocoa -- Emily Stone, founder and CEO, Uncommon Cacao

Stone also said that quality issues become a challenge when bulk cocoa is priced higher than specialty beans. “Producers may ask themselves: Why spend the time and effort complying with quality standards and practices if I can get such a high price from the buyer who requires nothing?”

Grindings data

The ICCO said that grindings data published by regional associations for Q4.2023 do not show significant changes compared to the Q4 period of the previous two cocoa years. Whereas Europe’s Q4.2023 cocoa grindings, as reported by the European Cocoa Association (ECA), fell by 2.5% from a year earlier to 350,739 tonnes, that of North America, published by the National Confectioners Association (NCA), declined by 2.9% year-on-year to 103,971 tonnes.

Data from the Cocoa Association of Asia (CAA) revealed an 8.49% year-on-year drop to 211,202 tonnes.

“With not much change in the volume of the beans processed for the Q4 period, does this depict that the traditional processing regions are drawing down on their stocks to maintain operations, and can this be sustained given the current global supply scenario?” The ICCO queried.

Stone said that the situation is challenging for many actors across the value chain, including aggregators and exporters whose cash needs have tripled in order to buy cacao at the skyrocketing prices and who are often scrambling to beat out local competition for limited supply to fulfill their contracted sales.

“The true costs of modern cacao production, which have been ignored for decades, are coming home to roost. I think we may be looking at a hard reset for cocoa.”