Baker & Baker has released the first of a series of ‘Bakery Bites’ reports to be published throughout 2022/23, which will provide bite-sized statistics and insights of the key issues impacting the bakery industry, such as high inflation, rising costs, HFSS, availability of raw materials and changes in consumer behaviour, among others.

The first delves into the vegan sweet bakery market in the UK, highlighting the significant opportunity for bakeries, foodservice operators and retailers. The standout – from research conducted by FMCG Gurus on behalf of Baker & Baker – is the growing number of flexitarians.

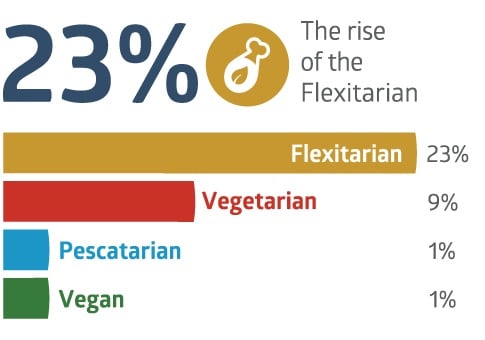

In fact, FMCG Gurus claims 34% of Brits follow a diet that avoids or moderates the consumption of animal-based products, up from 28% in 2020. The market researcher had surveyed 1,000 UK consumers in April 2022, nationally representative by age and gender.

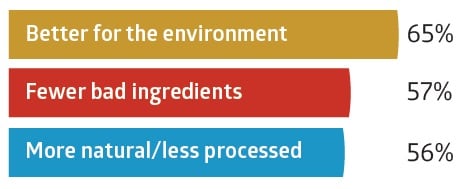

Moreover, this trend is set to continue, with 16% of those surveyed planning to up their intake of plants over the next 12 months, because such products are better for the environment (62%), healthier (54%), have a better nutritional value (47%), and are safer (27%), that is, more natural and less processed.

According to Baker & Baker, this UK growth is mirrored in the other European markets in which it operates.

“We’ve launched the Bakery Bites report concept at a time when so much is happening within the bakery sector, with the aim of sharing insights across the industry,” said Helen Sinclair, UK marketing manager at Baker & Baker.

“The first Bakery Bites report focuses on the vegan sweet bakery market, and the findings highlight a significant opportunity for bakeries, foodservice operators and retailers who offer quality vegan products that do not compromise on taste.”

Driven by self-expression

The rise of the flexitarian movement (23%) is well ahead of the number of consumers becoming vegetarian (9%) and vegan (1%).

“Most consumers following an alternative dietary plan in the UK identify themselves as being flexitarian and are driven by self-expression and want brands that they feel match their attitudes and outlook on life,” Mike Hughes, head of Research & Insight at FMCG Gurus, wrote in the report.

“Over the past two years, the pandemic has made consumers more conscious about their own dietary habits and the environment, as they evaluate factors they believe can have a negative impact on health.

“Moreover, while initial concerns have begun to fade regarding animal welfare – especially in certain countries – it is something that is having a greater influence on purchasing habits. Although much attention is given to the popularity of alternative diets among younger people, this is also a trend that resonates among older consumers, especially if they feel their health is not at a maximum level.”

The barriers

The biggest barrier preventing even more Brits to commit to the vegan lifestyle is, as always, taste, especially when today’s consumers is particularly prone to turning to products for moments of escapism. The sad truth is, historically, better-for-you products are linked with ‘bland’ and ‘boring’, while veganism is automatically associated with ‘sacrifice’ and ‘compromise’, added Hughes.

There is also a lack of real understanding around veganism, with 49% of those surveyed believing there is no difference between vegan-friendly and plant-based, and a further 15% unsure.

Thirdly, price is a factor, and veganism is often associated with costlier products. However, 44% of consumers said they would be happy to pay a premium if they felt assured over quality.

That’s reassuring given the often-increased manufacturing costs in producing vegan treats, however, said Baker & Baker, with the current inflationary environment playing havoc on literally everyone’s purses, it remains to be seen what impact this will have on overall sweet bakery sales.

“While great strides have been made in [vegan] NPD, there is still a perception issue with consumers,” said Hughes, noting 46% of consumers are still less likely to buy a sweet bakery product that has a vegan claim.

“More still needs to be done to overcome historic concerns about taste and quality, and the industry must invest the time and resource to better educate consumers.”

Not just for Veganuary

With flexitarian and vegan diets now mainstream and expected to grow, Sinclair said Baker & Baker has rolled out its vegan range in the UK, following successful launches in France and Germany last year.

“We launched our range of UK vegan products earlier in the year, based on offering products that also delivered on quality and taste,” added Sinclair.

The range includes a Pink Velvet Ring Doughnut with pink strawberry-flavoured icing; a Fruity Blueberry Muffin with a crumble topping; a Dark Chocolate Muffin with chunks of Belgian chocolate; and a Dark Chocolate Cookie Puck, which contains 30% chocolate that is Rainforest Alliance certified.

The doughnuts and cookie have been manufactured with sustainably certified palm oil, while the muffins are palm oil-free. The entire range is also void of artificial preservatives, flavourings and colourings.

The doughnut and muffins are simply thaw and serve, the cookies are baked from frozen and all have a shelf life of 2-5 days, meaning foodservice operators can maximise product availability while minimising waste.

Baker & Baker is one of Europe’s leading suppliers of bakery products under the Baker & Baker American Bakery, Goldfrost, Concadoro and Molco brands for the retail, foodservice and artisan channels. The baker also produces products under licensing brand agreements with Mondelez and Disney.