At the Consumer Analyst Group of New York (CAGNY) conference this week, Mondelēz CEO Irene Rosenfeld said that her firm saw opportunities in Russia, China and India to be active in all snack categories – chocolate, candy & gum and biscuits – and not just one or two.

Cross-category scope in emerging markets

“Our goal is to competing in all of our snack categories in each of our key markets,” she said.

“…We have significant white space opportunities. Today in most of our emerging markets we have a meaningful presence in only one or two snacks categories. For example Chinas is a biscuit and gum market, India is predominantly chocolate and Russia is largely a chocolate market although we have a significant coffee business as well.”

She said that the company’s $2bn business in Brazil was the only exception as Mondelēz has a meaningful presence in all its snack categories.

“We’ll continue to seek tack-on acquisitions to strengthen our positions in key countries and categories, especially in emerging markets,” said the Mondelēz chief.

Utilizing Kinh Do network

Rosenfeld added the company’s November 2014 acquisition of Kinh Do for $370 was consistent with that strategy.

Kinh Do is the Vietnamese leader in biscuits and mooncakes with $175m in annual sales in the fast growing Vietnamese market, which has 90 million consumers, half of whom are under 30. Mondelēz plans to help Kinh Do’s own brands grow but also hopes to use the business as a platform for Mondelēz brands.

“We’ll invest to introduce our power brands into their distribution network, covering 130,000 outlets,” said Rosenfeld. Mondelez’s 14 power brands – such as Cadbury, Milka, Oreo and Trident - account for over 60% of group sales.

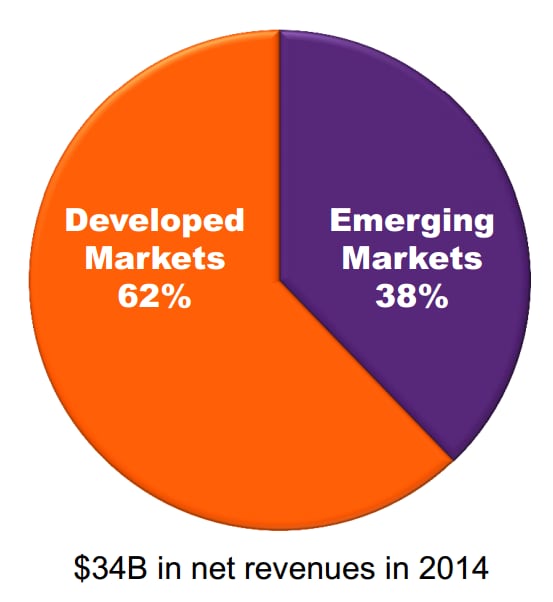

Around 38% of Mondelēz’s revenues come in emerging markets. “Although emerging markets have slowed somewhat recently they still grew 7% [in revenues for Mondelēz] last year. We expect emerging markets will continue to be our primary source of growth over the long term,” said Rosenfeld.

Acquisitions to fill gaps in developed markets

“While our acquisitions will be predominantly in emerging markets, we will continue to seek opportunities to fill portfolio gaps in developed countries as well,” continued the Mondelēz boss.

The company this week acquired Enjoy Life Foods, which is leader in US free-from snacks and has annual sales of $40m. “It’s a great fit with our strategy to expand into fast growing, on-trend, better-for-you areas,” said Rosenfeld. Mondelēz plans to revamp Enjoy Life Foods’ packaging and will look for opportunities to expand the brand in the US and overseas.

Distribution strategy in emerging markets

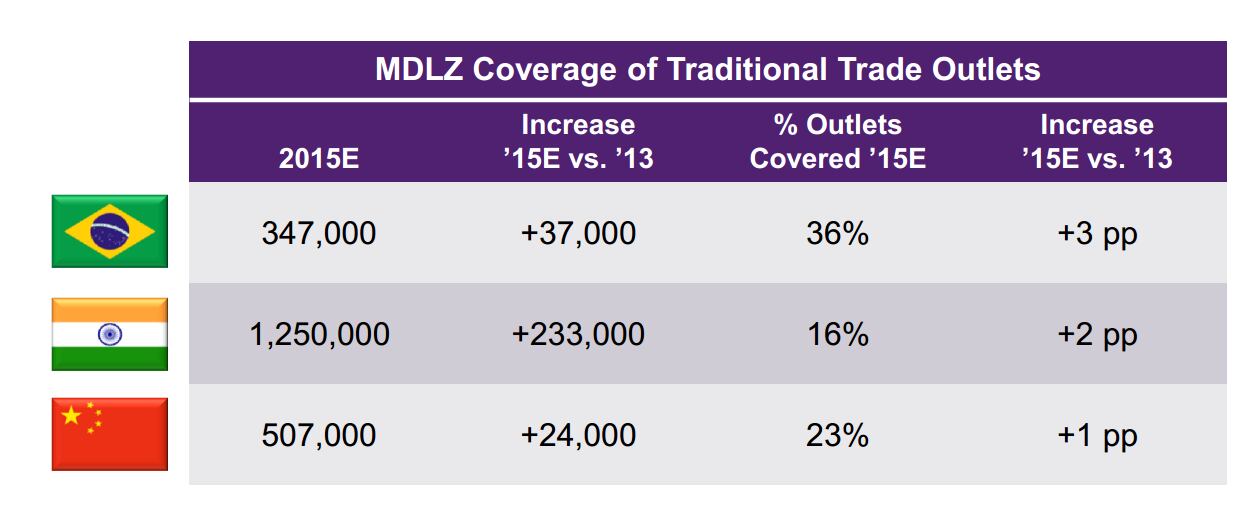

The Oreo owner also intends to grow distribution in traditional trade in emerging markets. “In Brazil we are continuing to expand our coverage in the major cities where we already have a presence as well as the fast growing North/North-East region,” said Rosenfeld. The company expects to cover a further 37,000 outlets in Brazil by the end of 2015, which is about 36% of total available outlets in the country.

“In India, although we are aiming to add an astounding 233,000 additional outlets, we’ll still only be covering 16% of the 7 million that sell confections,” said Rosenfeld.

The joint global confectionery leader will also add 24,000 outlets in China, taking its coverage to 23% of possible retailers.