The money will be used to fund its rapid growth in multiple markets and the growth of Tony’s Open Chain (its business-to-business ethical bean sourcing company). More bars and beans sold means more beans bought at the price of a living income, so more positive impact on the lives of cocoa farmers, the company said in a statement.

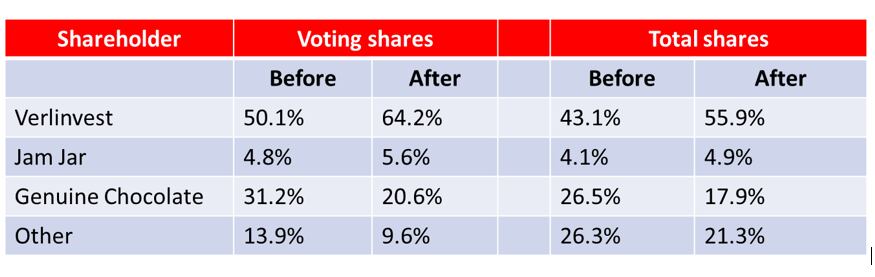

The full funding round is subject to regulatory approval in the Netherlands. The company said that as part of this round, a few existing shareholders would sell a small percentage of their stake. The revised shareholding percentages, following completion of the funding round, are outlined in the table below.

CEO Douglas Lamont commented “This investment will help us accelerate our progress towards our mission of ending exploitation in the cocoa industry. The funding will be used to support the rapid global growth we are delivering in both Tony’s Chocolonely, our chocolate business, and Tony’s Open Chain, our global business-to-business ethical bean trading company. I am delighted that all the funding was raised from within our existing shareholder base, who we know are all committed to supporting our long-term mission.

“With this new investment, with our governance structure and with our recently introduced Mission Lock we will all remain fully focused and committed to delivering on our mission to end exploitation in the cocoa industry. “

Shareholding table:

Notes to shareholding table:

- Whilst Verlinvest already held the majority of the voting shares prior to this transaction, the transaction is subject to Competition Authority approval in the Netherlands as a result of Verlinvest (a Belgium based investment company) increasing its shareholding.

- Jam Jar is the investment company, run by the former Innocent drinks founders

- Genuine Chocolate is the Holding company of the former CEO, Henk Jan Beltman, who stepped down in October 2022.