While the majority of British and European consumers consider bakery products a daily staple, they are not tucking in just for the sake of carbs.

“[Younger consumers are] particularly interested in functional health benefits, which is driving the popularity of segments like protein bars,” said Clara Mombeshora, senior consumer insights manager for Europe.

“Meanwhile, the introduction of HFSS legislation in the UK and the review of Nutri-Score have further emphasised the need for products that are lower in fat, sugar and salt.”

S.W.O.T

With the bakery market estimated to reach $272bn by 2027, this is a massive opportunity that all stakeholders – from major manufacturer to independent artisan – cannot afford to ignore.

“Our new report gives the opportunity to explore how different health needs influence the desire to purchase for different age groups and across different markets,” said Mombeshora.

Tate & Lyle’s Bakery Digest delves into what’s driving growth in the European bakery market, analysing consumer consumption and purchasing behaviour across a wide range of bakery products, including bread, cereals, cakes, biscuits, pastries and bars. The ingredients provider commissioned Coleman Parkes to target 1,250 18-year-old and upwards consumers across five markets: the UK, France, Germany, Spain and Poland – between August and September 2022.

Added Lin Peterse, category development manager for Bakery, “We [also] investigate how the cost-of-living crisis is changing buying habits, how perceptions of bakery products are changing for different age groups, and whether there’s still a place for indulgence as people focus more on their health.”

The health trend

Eating healthier today means much more to consumers than just low calorie or reduced sugar.

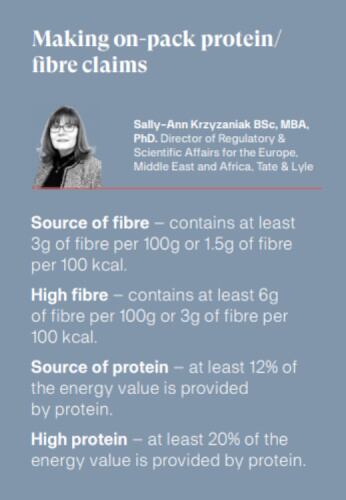

While “frequent bakery consumers told us that no added sugar in products was the biggest drive for them to increase their overall consumption (32%), followed by low fat (22%) and reduced calories (19%),” two-thirds are likely to choose something with added fibre claims (well known to support gut health).

Protein, too, is important, associated with building muscle mass, but also healthy ageing, appetite regulation and weight management. Meanwhile, one in five are on the lookout for clean label claims, which has evolved from the absence of ingredients perceived to be suspect and artificial to encompass the wider ‘free from’ concept.

“We’re noticing that there is a lot more focus on positive nutrition claims,” said Peterse.

“In addition to claims like reduced fat and reduced calories, consumers are increasingly seeking products that are high in fibre or high in protein. As a result, protein bars or high fibre snacks, which used to be considered ‘performance’ products, are becoming more mainstream, and consumers are also starting to look for fibre and protein claims on products like cakes and biscuits.”

Cutting back

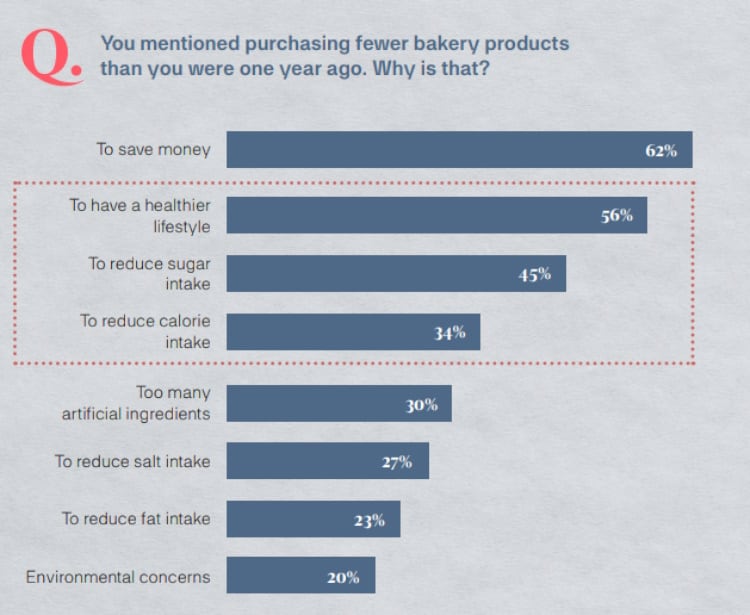

It will be no surprise that consumers have become more cost-conscious in the current environment, and that includes baked goods.

“Of those buying fewer bakery products, 62% said saving money was a key factor in cutting back, so cost will be key to attracting new customers,” added Peterse.

“Consumers are looking for value for money - but that doesn’t necessarily mean the cheapest products. Value can be found in premium products as they are seen as compensating for reduced spend on eating out of home; research by FMCG Gurus found 42% are cutting spend on eating out of home and around 40% of those are looking for premium treats at home instead.”

Shoppers are also taking the time to think about managing their spend, with 67% preparing shopping lists; 38% setting a budget; and 41% taking greater advantage of promotional offerings. Instore promotions ranked as the biggest influence on buying decisions in the UK when it comes to bakery products, ahead of adverts and recommendations from friends and family. Meanwhile, 52% are getting to grips with their inner baker to bake their own treats at home.

However, it all comes back to the overarching health trend.

“Consumers also see value in additional health benefits,” said Peterse.

“Ultimately, bakers’ product ranges must deliver on both value and health, while also providing more premium and indulgent treats.”

Still, even though times are tight, shoppers aren’t willing to sacrifice on taste, their most important purchase driver across all product types.

Which brings us to the push for reformulation, which for many, is a red light for indulgent innovation. The bakery category, in particular, is being affected by restrictions on front-of-pack labelling, advertisement and instore displays.

HFSS

The UK government rolled out the first phase of the HFSS regulations last year, which restricts the display of products deemed high in fat, salt and sugar on aisle ends, by checkouts and even has implications on shelf space. In 2025, the government is expected to finally introduce the restrictions on volume-led promotions, like buy one get one free, while restrictions on TV and online advertising before 9pm will come into play.

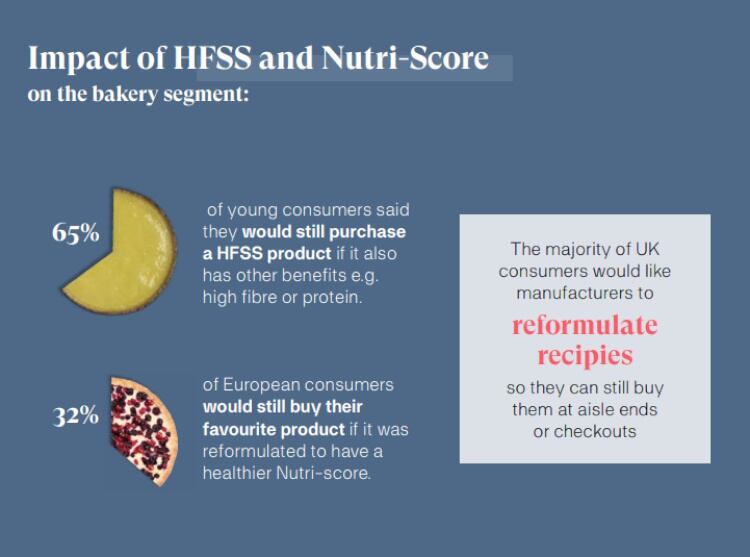

While 71% of consumers claim an HFSS categorisation doesn’t put them off buying an indulgent treat, 65% call for manufacturers to reformulate so they can still enjoy the convenience of buying them at aisle ends or by checkouts.

“It means manufacturers may need to review some of their formulations to attract new consumers and keep existing ones,” said Peterse.

Noting two thirds of those surveyed – especially the younger set – will buy HFSS products if they have additional health benefits, like high protein or fibre, she added, “when it comes to product reformulation, it has got to be a balancing act between making products healthier while maintaining quality.”

In fact, reformulation can actually work in the baker’s favour.

“For example, if you switch out a large quantity of sugar you will need to find a way to maintain texture and mouthfeel, which might mean adding fibres, such as our Promitor Soluble Fibre.”

The restrictions affect different categories in different ways; people are less concerned about whether a cake or biscuit is HFSS, but they are not as likely to buy an HFSS snack bar.

“When looking for a treat, for example, almost one quarter (24%) of young people choose a low or no sugar snack bar,” said Mombeshora.

“Protein, energy and nut bars are becoming a more popular snacking choice for younger consumers, with the bar segment having grown 18.5% in value and 4.6% in volume in the last year, according to Nielsen Data. We expect this category to continue growing, becoming a mainstream choice for those with active lifestyles, not just a sports nutrition focus.”

Nutri-Score

While not as restrictive, the Nutri-Score system – which has been around since 2017 in certain European countries – is designed to help consumers make healthier choices, with unfavourable components like calories, sugar, saturated fat given the red light (E rating).

It’s equally effective in tailoring consumer’s purchasing habits, with 61% admitting to switching to a different bakery product with a better score. More than 50% chose bakery products with a B/C rating instead of D/E, however, seven in 10 would still choose a product with a higher Nutri-Score if it also sports other benefits.

Again the high cost of living comes in to play, with 68% of Europeans claiming they would buy more B Nutri-Score products if they were discounted.