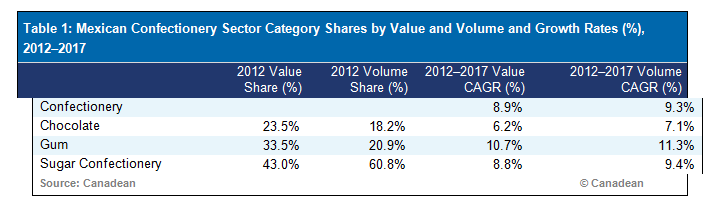

The $1.2bn confectionery market in Mexico is set for a compound annual growth rate (CAGR) of 8.9% between 2012 and 2017 with volumes currently at 177m kg due to rise 9.3% each year.

Rapid gum growth

The Mexican sugar confectionery market, worth $2.2bn is the largest category in both value and volume terms, but the next largest, gum, is set for the highest growth rates.

The $1.7bn gum category is forecast for a CAGR of 10.7% in value and 11.7% in volume growth each year.

Over the five years, it won’t overtake sugar confectionery, which is set to grow 8.9% in value terms each year, but gum will extend its lead over the $1.2bn chocolate category, which will grow at a slower rate of 6.2% every year.

Canadean report analyst Ronan Stafford told ConfectioneryNews.com that Mexico’s young population would help the gum category to excel.

Young, obese population

According to the CIA’s world Factbook, 45.5% of Mexicans are under 24, while 24.4% are under 14.

“With gum there is far more potential to include positive nutrition,” said Stafford.

Gum fortified with Vitamin-C, iron or zinc will score well in a country where health has become a major public concern.

Around a third of Mexicans over 15 are obese and this figure is forecast to rise to a staggering 46% by 2016, according to Euromonitor International.

“Consumers do see gum as a healthy product…it’s very difficult to sell healthy chocolate,” said Stafford.

Fruit-flavored preference

Canadean’s research found that gum and jellies were the most popular form of sugar confectionery, just ahead of boiled sweets.

Mints have the lowest share of the category and growth is forecast to be the slowest in the segment.

For gums: “It tends to be a lot more fruit-based flavors, such as strawberry,” said Stafford.

Market shares and gum tax proposal

Data from Euromonitor International shows that Mondelez commands 64.2% of the Mexican gum market mostly through Trident, ahead of its nearest rival Mars/Wrigley on 10.2%.

The next largest player is domestic firm Chicles Canel’s on 8.1%, while Pepsico holds a 2.7% share, partly through its stake in Productos Industrializados del Saltillo (PISSA). Hershey also has a modest 0.9% of the market.

Last November, Mexico’s leading party said it was considering forcing gum manufacturers to pay a 50% tax on top of the selling price of products to pay for clean-up costs on streets.